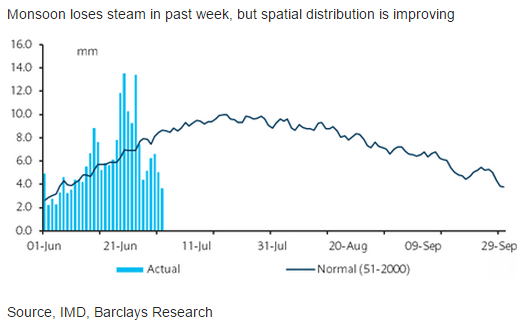

The south-west monsoon rains are reverting back to normal territory. After a significant improvement in late June, rainfall conditions are normalising. Cumulative rainfall between 1 June and 2 July stood at 10% above normal, down from a 28% surplus last week.

The positive news is that rainfall conditions are also improving on a spatial basis, with 31 out of 36 regions now showing excess or normal rainfall conditions, with another three regions close to normal conditions.

While there has been a good start to the monsoon season this year, July-August remain the key months.

The Indian Meteorological Department (IMD) now forecasts rainfall to be below normal in July, and maintains it seasonal forecast at 88% of the long-period average. Another private agency Skymet, however, is forecasting rainfall to be normal in July.

In the meantime, the sowing activity is improving rapidly, up 23.4% relative to 2014 as of 26 June, with strong increase seen in pulses (~80%) and oilseeds (473%). The government has also made inflation management a top priority, by placing import orders for wheat, pulses and oilseeds. These food commodities have seen price increases recently, according to high-frequency data.

The Reserve Bank of India (RBI) in its recent statement noted that monsoon-related risks dominate its concerns around inflation, although the governor recently noted that the progress of the monsoon this year has been good. Although India's headline inflation remains manageable, risks around food inflation persist.

Barclays notes:

- We think the lack of an increase in MSPs in mid-June for the summer crops is a welcome sign.

- We forecast FY 15-16 average CPI inflation of 5% (H1 FY 15-16: 4.5%, H2 FY 15-16: 5.5%).

- We expect monetary policy in the coming months to continue to be data-dependent.

- Despite the RBI's recent cautious guidance, the risk of another cut in H2 FY 15 remains, in our view.

However, such potential action will remain contingent on greater clarity on a number of factors, including trends in commodity prices, the monsoon outcome, the likely 2016 inflation trajectory and the impact of a potential Fed rate hike, possibly in H2 15.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022