The International Monetary Fund (IMF) has remained wary over the medium-term growth outlook of advanced economies, besides, foreseeing financial risks in China, at the IMF’s annual meeting. The forecast of financial risks emerging in China has called for the authorities to take immediate steps to address the vulnerabilities.

Meetings on emerging markets were generally more positive, especially for key emerging markets such as Russia, Mexico and Brazil, as the countries are pursuing relatively orthodox and prudent macroeconomic policies, boosting an economic recovery. The IMF seems clearly concerned about increasing financial risks in China. While it does not see an immediate crisis, there is an urgent need that the Chinese authorities take steps to address the vulnerabilities Danske Bank reported.

In addition, the supreme monetary authority sees a two-speed economic development in Africa currently. The continent’s big commodity-producing countries, Nigeria, Angola and South Africa, are struggling and need structural adjustment to cope with the ‘low for longer’ outlook for commodity prices.

However, in oil-importing African countries, economic growth continues to be solid, due to the expansion of public investment, regional integration and population growth; notably, Kenya, Tanzania, Rwanda and Uganda are doing particularly well, the report added.

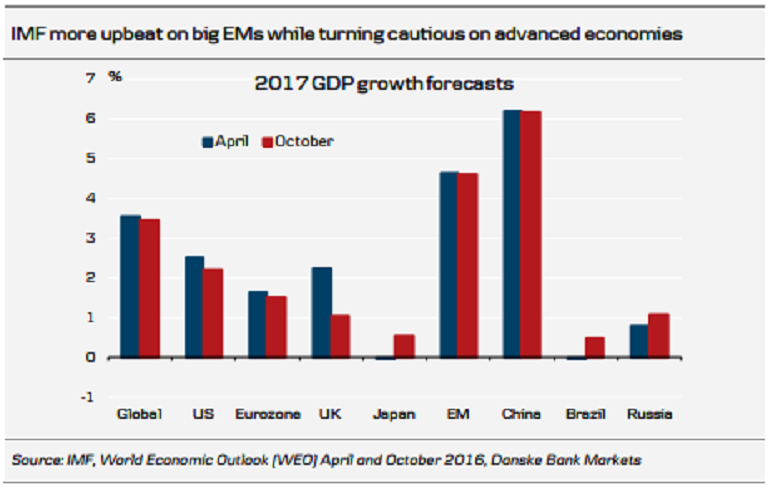

The outlook for the global economy points to subdued economic growth. Emerging markets are dominating the world economy increasingly. Indeed, the main reason behind the increase in global growth over the next five years is the increasing weight of relatively fast-growing emerging markets. There are fewer worries about China in the short term but more concerns about the medium term. Advanced economies will only contribute very remotely to the pickup in growth.

Further, low inflation presents a significant challenge to policymakers in advanced economies. The decline in inflation goes beyond the commodity price fall. Persistent economic slack also plays a significant role in pushing down inflation.

Meanwhile, a study by the IMF finds demand and its composition explain 80 percent of the slowdown in trade over the past few years; importantly, the sluggishness of investments in recent years, which is typically quite trade intensive compared with consumption, the report further noted.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility