After PBoC's trade-weighted view of CNY during a last weekend, the warning shot from PBoC for the Fed as 'FX Wars', we don't think Fed takes into account very seriously.

Once the expected Fed rate hike becomes reality, even though the market has already likely priced in the rate hike, the Chinese Yuan is likely to continue to be devalued, as more capital flows out from China seeking better returns.

Chinese regulators may adjust the speed of capital outflow by turning down the capital tap, but truly it is no longer able to fully shut it off as China is already on the one-way road to opening up its capital markets and liberalize its currency. Over-regulation of capital flows and Chinese Yuan exchange rates during the transition period will likely lead to international criticism.

For obvious reasons, markets will remain focused on that crucial event, which is set to have a major impact on almost all asset classes.

In particular, there is a well-documented concern over how emerging markets, where growth has slowed and USD-denominated debt has risen sharply, will cope with tighter US monetary policy.

Against this backdrop, it is arguably not a coincidence that China has just 'surprised' the markets once again.

From China's perspective that stance is entirely reasonable and economically pragmatic (which is why we have a bearish CNY forecast of around 7.0 in the short-to-medium term, followed by a fall as far as 7.75, where USD/HKD sits, by end-2016).

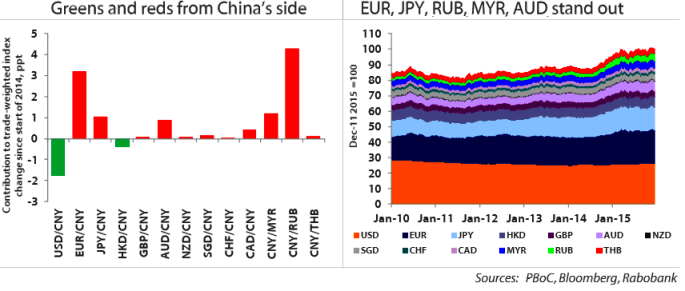

As per the above charts, currency segments that influences the surge in CNY's TWI.

RUB, which collapsed last year and then again 2015, and is currently still testing towards record lows: that means it has contributed 4.3% points to China's TWI index even though RUB has a relatively low weighting overall in it.

EUR - Since the ECB's carefully engineered (but recently stalled) EUR depreciation has added 3.2 poins to China's TWI.

MYR - 0where once again a collapse in a commodity led currency has seen CNY appreciate in response, this time adding 1.2 points to the TWI.

JPY - where the BoJ's original leadership in 'kitchen-sink' QE helped to add another 1.0 point.

AUD, where a further decline this year has added 0.9 points to Chinese trade-weighted basket despite a relatively low TWI weighting.

A data-dry Asian session, with markets taking advantage of the renewed risk-on sentiment amid recovery seen in global equities and commodities' prices. Hence, the higher yielding currencies such as the Antipodes, sterling and the greenback received fresh boost.

Although we've predetermined perspectives in multi-dimensions, we should only wait and watch until 19:00 GMT to get crystal clear clarity.

How Can CNY get benefited through TWI? Which currency crosses may push CNY? Does Fed disregard PBoC's TWI?

Wednesday, December 16, 2015 12:36 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary