Higher energy prices, coupled with a revival in investment spending pose potential risks to India’s current account deficits, enlarging possibilities of a widened deficit in the near term.

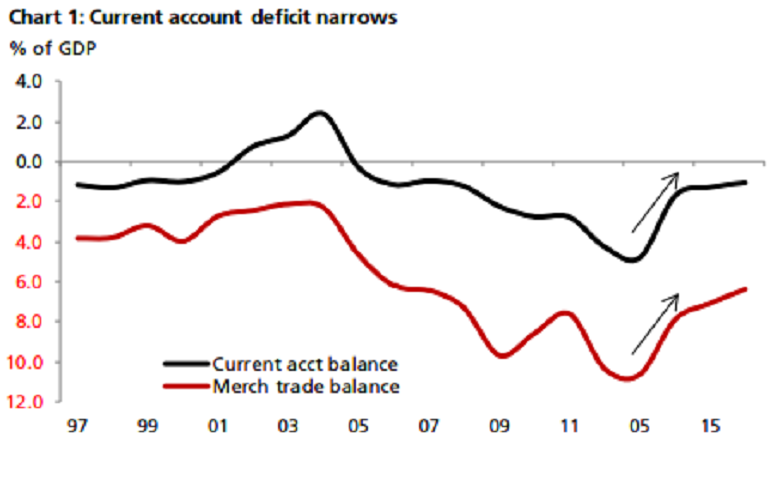

India has run current account deficits (CADs) since the early-1990s, except for a brief period in 2002-04. The deficit averaged 1-2.5 percent of gross domestic product (GDP) over most of the past decade before rising to 4 percent in FY12-13 on the back of a jump in oil imports and gold purchases. It has since fallen back to about 1 percent of GDP and is expected to remain about there for the foreseeable future, DBS reported.

India’s CAD narrowed to 1.7 percent of GDP during the fiscal year 2013-14, from a huge 4.8 percent same period a year ago. A smaller merchandise trade deficit, owing to fall in gold purchases led to the decline. The sharp fall in demand for the yellow metal was engineered through a host of trade and administrative curbs, leading to a sharp 70 percent dive in the metal’s imports in FY13-14. Global commodity prices were also softening, helping cap oil imports.

At the present scenario, the current account has largely benefited from a fall in imports rather than greater exports. The sharp drop in crude prices cut the oil import bill by one-third, while subdued investment demand kept a lid on non-gold non-oil purchases. The latter fell 9.0 percent during Apr-Jul 2016 compared to -4.0 percent during FY15-16.

Amongst invisibles, service receipts and private transfers and/or remittances are also showing signs of strain. Thus the current improvement in the current account is not as favorable as the one in 2002-04. Against this backdrop, the CAD should narrow to 0.8-0.9 percent of GDP from 1.1 percent in FY15-16. A stronger current account balance would be at risk if crude prices hit above USD 60/bbl this year, DBS reported.

At the same time, a pickup in investment could also lift imports, putting renewed pressure on the current account. If these risks materialize, a return to the long-term deficit range of 1.5-2.0 percent of GDP would likely follow. While the size of the current account is important, how it is financed is equally imperative.

"Given the government’s move to raise limits/ relax sector-specific regulations for FDI, undertake reforms to improve the ease of doing business and efforts to streamline the investment process, we expect foreign investment flows to improve in the coming years," DBS commented in its latest research report.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility