By purchasing 760,190 SOL tokens valued at $167 million, Helius Medical Technologies has made a strategic shift from neurotechnology to become a significant Solana treasury business. With an average price of $231 per token, Solana is the second-biggest public holder after Forward Industries, following a $500 million private placement. Under the guidance of Pantera Capital and Summer Capital, NASDAQ-listed firm HSDT has kept almost $335 million in cash for upcoming purchases while positioning itself among the emerging group of businesses using Solana for treasury management, including DeFi Development Corp and Upexi. Because of its 7% native staking return, better transaction processing capacity of more than 3,500 transactions per second, and development, representing a larger corporate treasury revolution whereby businesses are spreading beyond conventional assets into yield-generating digital assets, the DeFi ecosystem offers several revenue-generating opportunities.

Market Movements: Navigating the Price Trends of SOL

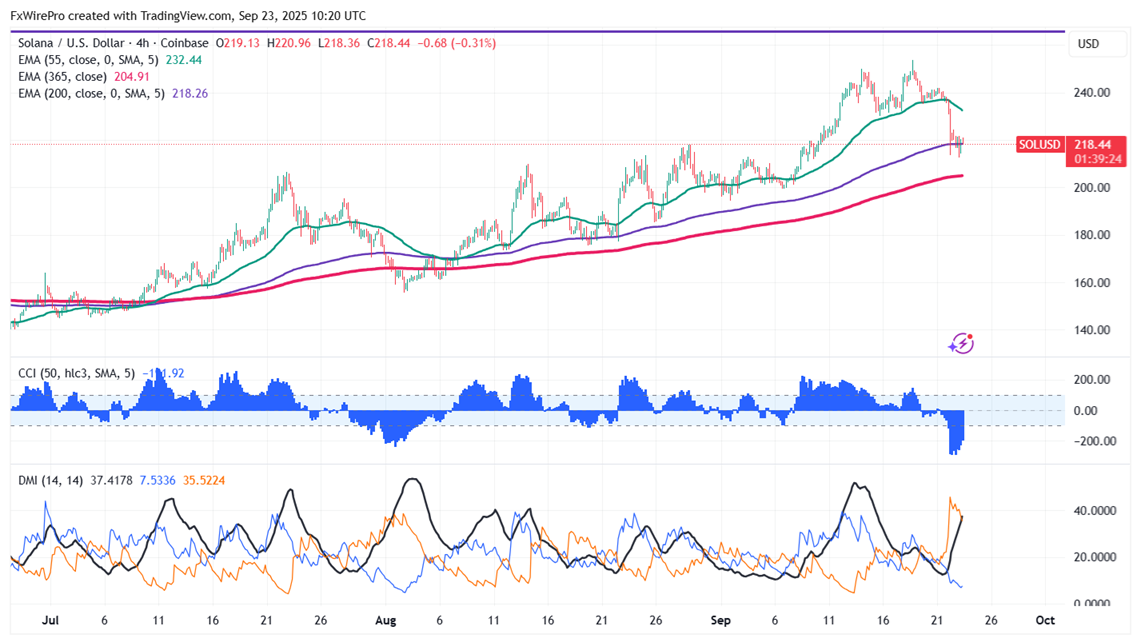

The SOL/USD declined more than 15% following the footsteps of BTC. Near-term support is identified at $200, with a drop below this level potentially leading to targets of $180/$140/$123/$117/$100. Immediate resistance is noted at around $225, where a breach could push prices up to $265/$300, or even $350.

It is good to buy on dips around $200, with a stop-loss set at $160 and a target price of $300/$350.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary