Glencore's decision to cut zinc production by 500,000 tons is boosting prices today. Zinc is up 10% already, which makes it biggest single day rally in 26 years.

However that is not stopping the investment banks to cut further outlook for metals.

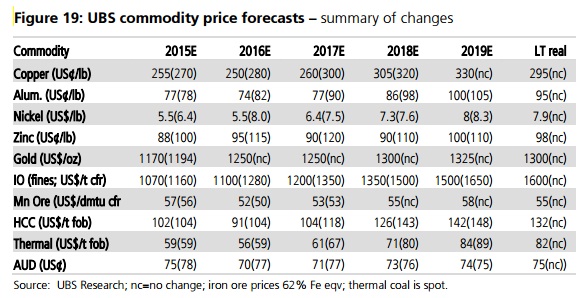

According to a report from Financial Times, UBS and Goldman Sachs both have reduced their forecast for the metals. Figure courtesy UBS and Financial Times.

According to UBS

- UBS notes that though Chinese property recovery has continued, large stocks have prevented any major comeback in construction and demand for commodities. Moreover slowdown in BRICS is likely to have weakened demand. Recoveries in US, Europe and Japan susceptible to Emerging market slowdown.

- UBS's copper forecast is now 6% lower for the end of this year, now at $2.55/lb. For the end of next year, it's 11% lower at $2.50/lb. (spot now around $2.41/lb.)

- Its nickel forecasts are now 31 per cent lower for the end of next year, now at $5.50/lb. (Spot is now at $4.79/lb.)

- Lead forecasts are now 5% lower for this year (to $0.81/lb.), 16 per cent for next year, and 20 per cent lower for 2017 (spot now at $0.80/lb.)

While Goldman Sachs says,

- Emerging market deleveraging has just begun and current leverage ratio still at very high.

- According to the bank three key factors, deleveraging in the emerging markets, divergence of US growth (a strong dollar environment) and deflation of dollar mining costs, represent substantial ongoing macroeconomic headwinds for metals markets.

- According to Goldman analysts, recovery can be seen in Zinc and Nickel, while Copper and Aluminium are likely to decline further.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate