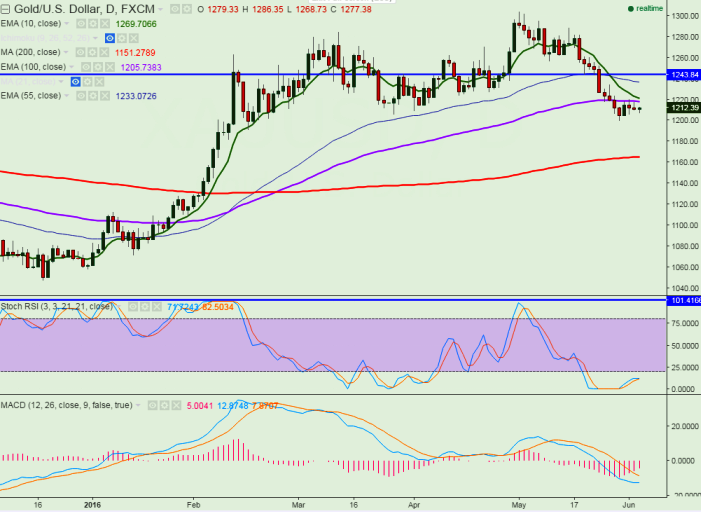

- Major resistance- $1223 (10 day EMA)

- The yellow metal has slightly declined after making a high of $1217.86. It is currently trading at $1212.

- Market awaits US Non Farm Payroll for further direction .Non –farm-payroll is expected to show 162k growth in May compared to 160k in the month of Apr and unemployment rate to slip from 5% to 4.9%.

- Gold’s major resistance around $1223 (10 day EMA) and any slight bullishness only above that level.

- Any indicative break above $1223 will take the commodity till $1230/$1235/$1239 level. Short term bullishness only above $1243 (support turned into resistance).

- On the lower side major support is around $1200 and any break below targets $1190/$1175/$1160.

It is good to sell below $1200 with SL around $1221 for the TP of $1160