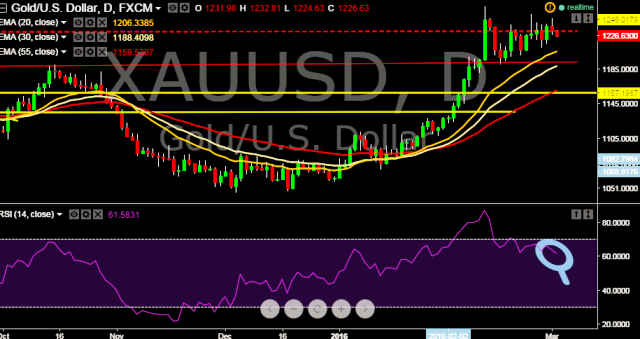

- Pair is currently trading at $1226 levels.

- It made intraday high at $1232 and low at $1224 levels.

- Pair likely to consolidate below $1248 marks and intraday bias remains slightly bearish for the moment.

- A daily close above $1248 will drag the parity towards key resistance at $1263/$1292 thereafter.

- Current week will be important for the Gold as US will publish ADP job data later today and NFP job data on Friday.

- Key support level falls at $1200/$1190 levels.

We prefer to take long position in XAU/USD around $1216, stop loss $1200 and take profit $1232/$1248 levels.