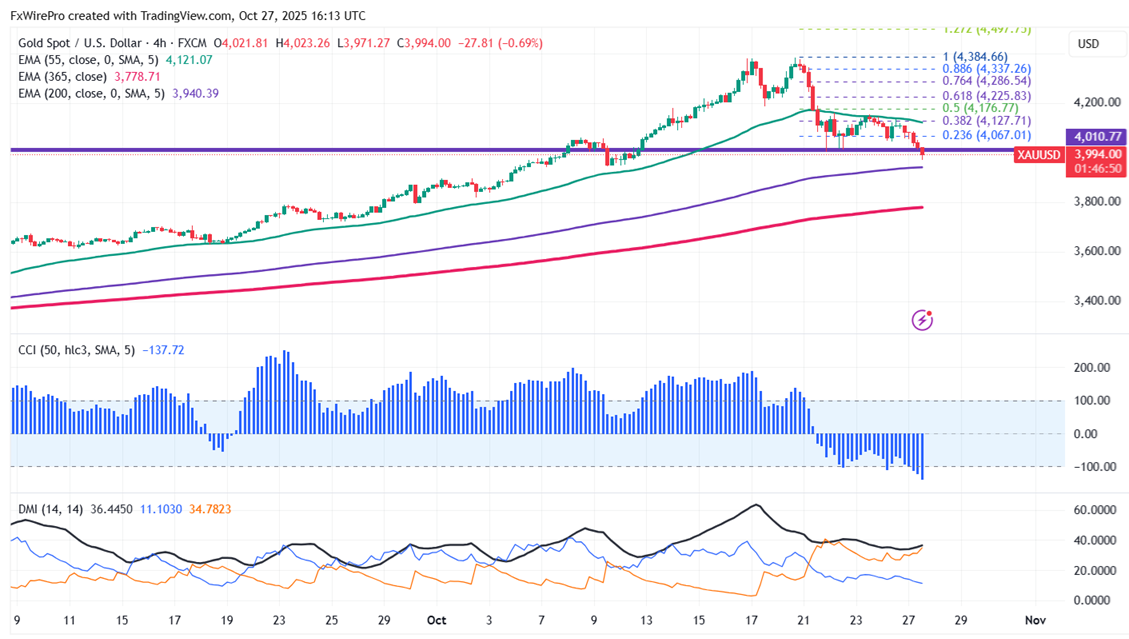

Due to easing US-China trade tensions, gold lost more than 3% today. The yellow metal broke a significant support $4000 after a long consolidation. It hits an intraday low of $3971 and is currently trading around $3984.

Near-term support - $3960. Any breach below will drag the yellow metal down to $3934/$3895/$3800/$3770/$3500.

Significant resistance - $4025. Any violation above this level will push the commodity to $4065/$4100/$4155.

It is good to sell on rallies around $4038-40 with SL around $4155 for a TP of $3500.