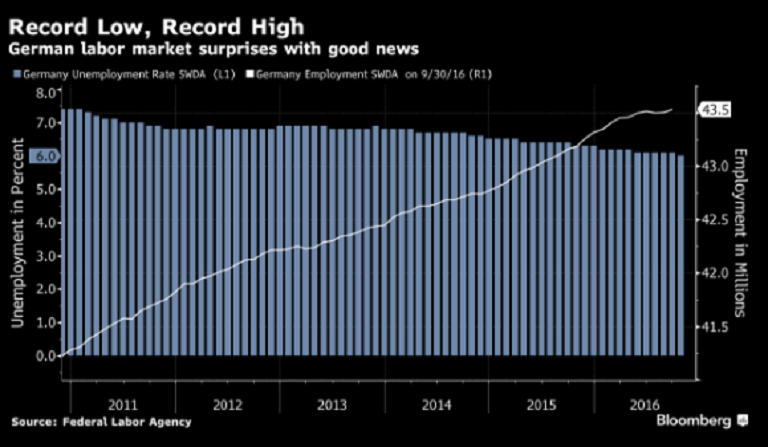

The unemployment rate in Germany fell to a new record low during the month of October, declining more than what markets had initially anticipated, while job vacancies hit a fresh all-time high during the same period.

Germany’s seasonally adjusted jobless total fell by 13,000 to 2.662 million, data released by the Department of Labour showed Wednesday. That compared with a consensus forecast in a Reuters poll for unemployment to fall by only 1,000.

The adjusted unemployment rate edged lower by 0.1 percentage point to 6.0 percent, the lowest level since German reunification in 1990. Further, the number of job vacancies also hit a record high of 691,000, suggesting companies are increasingly struggling to find new staff quickly on the labor market.

In addition, the number of people out of work fell by some 6,000 in western Germany and decreased by about 8,000 in the eastern part of the country, the labor agency said. At the same time, underemployment rose by a seasonally adjusted 11,000 nationwide due to a loosening of labor policies to target refugees, according to the report.

Meanwhile, manufacturing grew at the fastest pace in almost three years in October, according to final data published by IHS Markit on Wednesday, as companies boosted hiring, partially in response to stronger foreign demand from the U.S and Asia. The country’s central bank has pointed to export and business expectations in manufacturing as signs that the situation could improve in the coming month, Bloomberg reported.

"Due to the autumn pickup, unemployment fell significantly, employment rose again and demand for new staff increased further," Reuters reported, citing Frank-Juergen Weise, Head, Federal Labour Office.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears