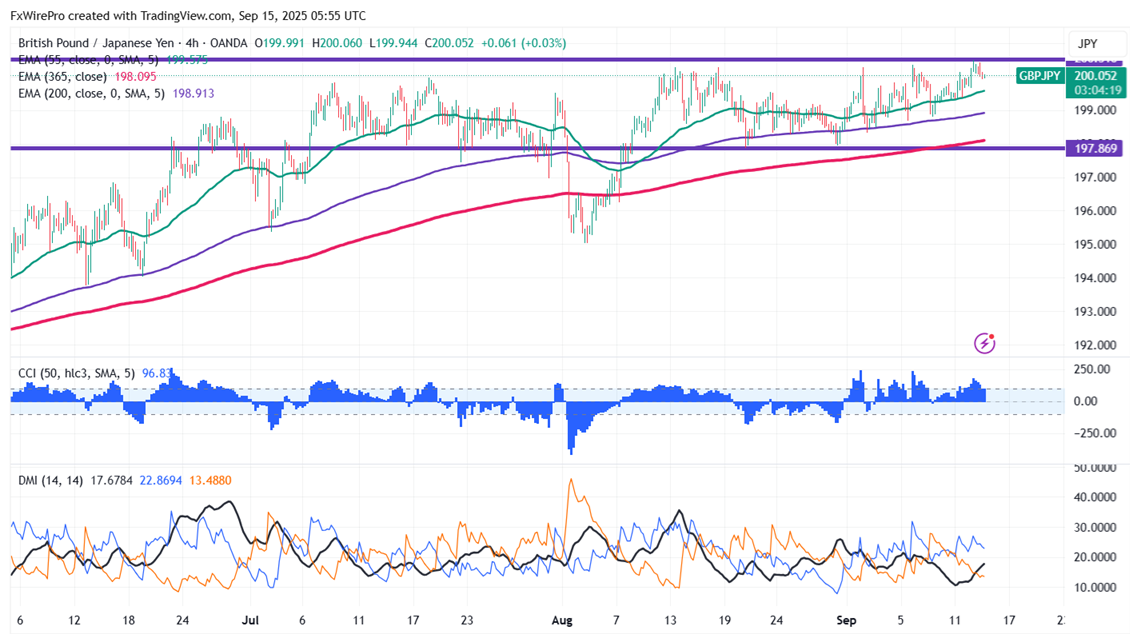

GBPJPY trades flat after hitting a fresh year high. The intraday trend is bullish as long as the support at 199.55 holds. Currently, trading around 200.04, the pair reached an intraday high of 200.12.

The pair is trading above 55 and 200 EMA and 365 EMA (long-term) on the 4-hour chart, confirming a bullish trend. Any violation below 199.50 indicates the intraday trend is weak. A dip to 199.20/198.75 /198/197.85/197.25/ 196.70/196.20/195 is possible. Immediate resistance is at 200.50; a breach above this level targets 202/203.

Market Indicators ( 4-hour chart)

CCI (50)- Bullish

Directional movement index - Neutral

Trading Strategy: Buy

It is good to buy on dips around 199.88-90 with SL around 199.35 for a TP of 202/203.