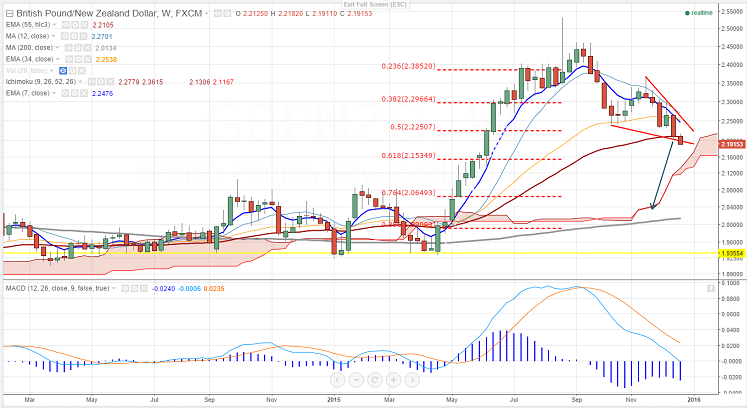

Major trend line support -2.2000 (trend line joining 2.24179 and 2.2043)

- GBP/NZD has slightly recovered till 2.2180 yesterday and started to decline from this level. It is currently trading around 2.19333.

- The pair has broken major trend line support in weekly chart and declined well below that level. Overall trend is still weak as long as resistance 2.2478 (7 W EMA) holds.

- Any break above 2.2535 will take the pair to next level 2.2708/2. the lower side break below 2.200 confirms major trend reversal . a decline till 2.15/2.13/2.065 is possible .

It is good to sell on rallies around 2.1950-2.2000 with SL around 2.250 for the TP of 2.150/2.130/2.065.