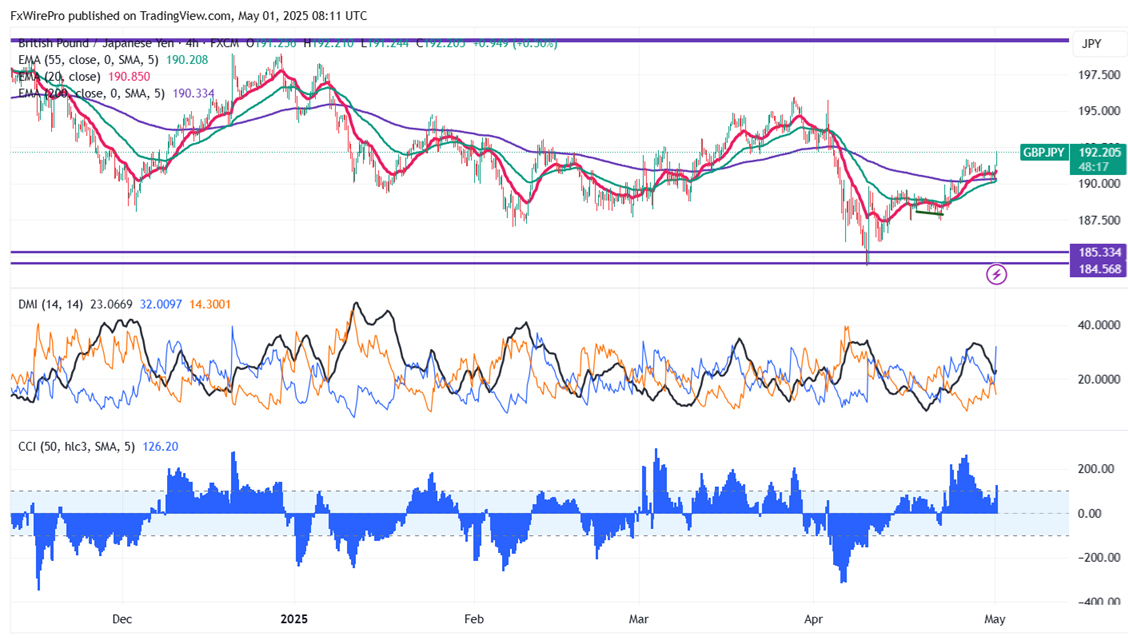

GBP/JPY breaks significant resistance 192 after a long consolidation. It hit a high of 192.18 at the time of writing and is currently trading around 192.10. Intraday trend is bullish as long as support 190 holds.

In May 2025, the Bank of Japan (BOJ) maintained its interest rate at 0.50%, keeping in view increasing uncertainty due to U.S. tariffs for trade and decelerating global growth. FY2025 and FY2026 inflation expectations were lowered to 2.2% and 1.7%, respectively, and GDP growth in FY2025 is supposed to be lower than estimated before at 1.1%. The BOJ signaled that future rate increases depend on economic and price development track projections, with timing heavily reliant on tariff effects. The dovish tone, together with Governor Ueda's suggestions of possible delays in reaching the 2% inflation goal, drove a rise in USD/JPY and supports expectations of ongoing accommodative monetary conditions, again bolstered by government support subsidies and firm assistance measures

The GBP/JPY pair is trading above 34 and 55 EMA (Short-term) and 200 EMA (long-term on the 4-hour chart, confirming a bullish trend. Immediate resistance is at 192..30, a breach above this level targets of 193/193.65/195. Downside support is at 191.65/191/190.40/190.

Market Indicators

CCI (50)- Bullish

Directional movement index - Bullish

Trading Strategy: Buy on dips

It Is good to buy on dips around 191.67 with SL around 190.40 for a TP of 195.