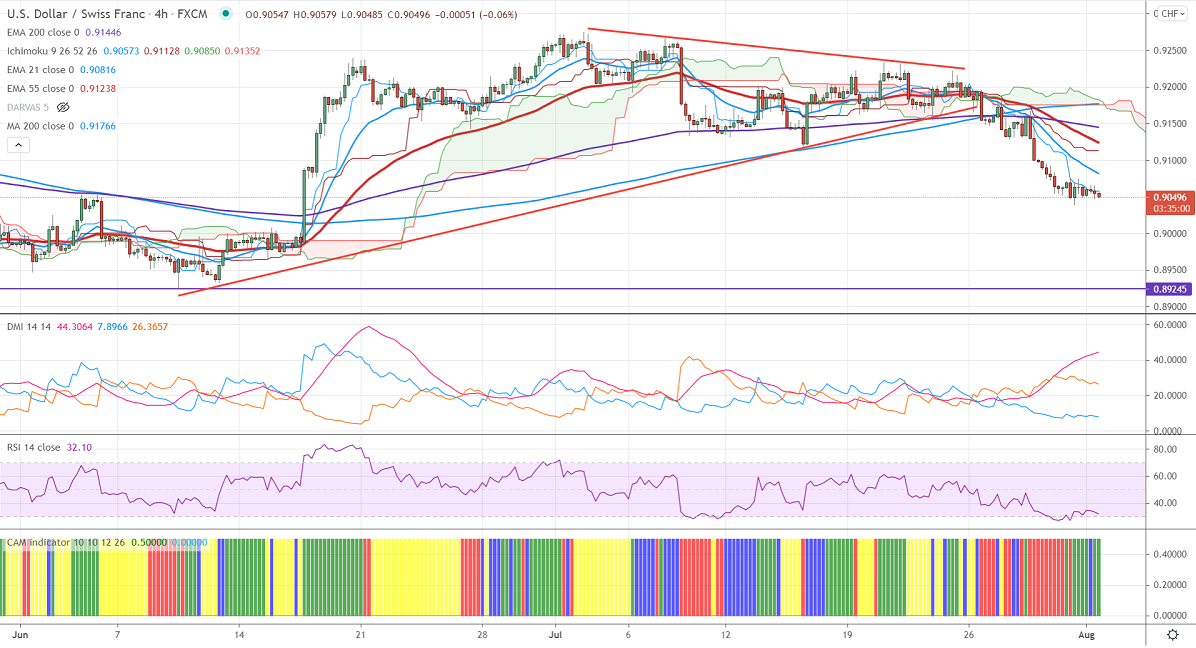

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.90573

Kijun-Sen- 0.9128

This week High– 0.92326

The pair continues to trade lower for the past five trading days on board-based US dollar selling. The US PCE index came at 3.5% year-over-year in June compared to a forecast of 3.6, the biggest moves since 1991. The Chicago PMI rose to 73.4 in July from 66.1 in June. Markets eye US ISM manufacturing index for further direction.USDCHF hits an intraday high of 0.90658 and currently trading around 0.90506.

.

Trend- Bearish

The near-term support is around 0.90390, any breach below confirms further weakness. A dip till 0.9000/0.8925. On the higher side, immediate resistance is around 0.9075. Any convincing breach above targets 0.91150 (support turned into resistance)/ 0.9128/0.9150/0.9185.

.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index –Bearish

It is good to sell on rallies around 0.9075 with SL around 0.9120 for a TP of 0.8925.