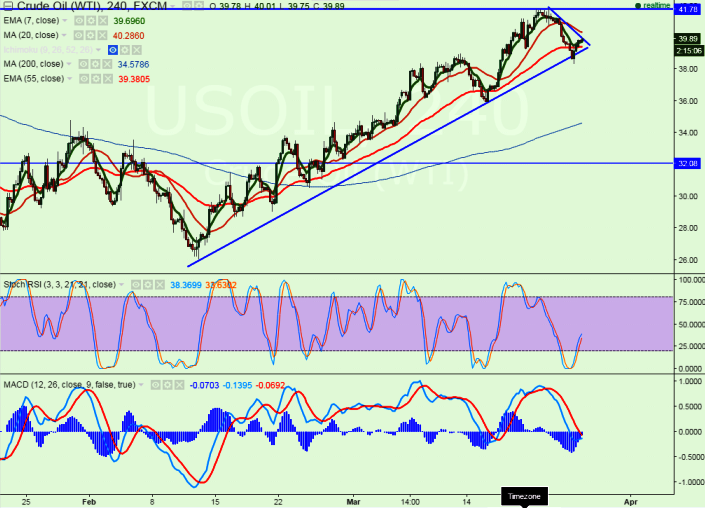

- Major resistance - $40 (trend line joining $41.85 and $41.22)

- Major support - $38

- The commodity has made a slight jump till $40.01 at the time of writing and slightly declined from that level. It is currently trading around $39.94.

- On the lower minor support is around $39.35 (55 day 4H EMA) and any break below targets $38.90/$38.

- Any break or close above $40 will take the commodity to next level till $41.20/$41.85.

- Further bullishness can be seen if it breaks above $41.85 (temporary top) level.

It is good to buy at dips around $39.60-70 with SL around $38.90 for the TP of $41.22/$41.85