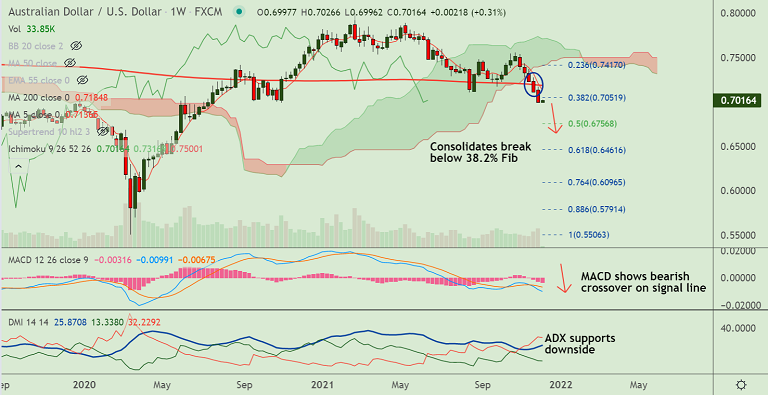

Chart - Courtesy Trading View

AUD/USD was trading 0.27% higher on the day at 0.7013 at around 07:10 GMT.

The pair has paused a 5-week downward streak and is consolidating break below 38.2% Fib.

Antipodeans attempting a bounce in Asian trade amidst ebbing concerns about Omicron variant.

News showed that preliminary observations from South Africa suggested Omicron patients had relatively mild symptoms.

A mixed U.S. jobs report last week failed to shake market expectations of a more aggressive U.S. tightening.

Focus now on the US consumer price inflation report due on Friday which could likely strengthen the case for an early tapering and a stronger dollar.

Technical bias for the pair is bearish. Price action has closed below 38.2% Fib. Scope for further downside.