Let’s shed some light on OTC FX:

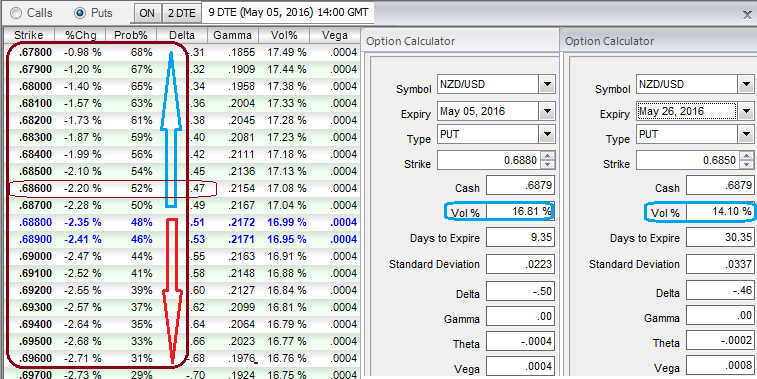

Since, ATM IVs of 1W expiries are at 16.98% and 14.08% for 1M tenors, so the volatilities implied in FX option market of this pair is likely to perceive higher volatility times which is good news for option holders.

Subsequently, have glance on sensitivity table as well for the different rate scenarios and their probabilistic outcomes. We've just referred 0.25% OTM put strikes and their vols, it still shows 0.47 as delta values for underlying outrights with 52% of probabilities, that means 52% chances of finishing in-the-money.

Glimpse on Technicals:

Technically, NZDUSD has formed 3 black crows candlestick pattern at peaks of intermediate trend, which is bearish in nature. In addition to that, ever since the pair has bounced back from the lows of 0.6347 levels, Kiwi dollar seemed like consolidating stronger from last couple of weeks but for now “Shooting Star” pattern occurred at 0.6851 levels.

As a result of the formation of this bearish pattern, current prices have slid below DMAs. We wouldn't be surprised if the spot FX drifts upto 30-40 pips below current levels of 0.6875 levels in no time or 20-25 pips on northwards in intraday terms.

FX Option Strategy:

Contemplating both OTC as well as technical observation, in order to deal with the puzzling swings in NZDUSD, “Call BWB spread” is an advocated where you take a traditional butterfly spread above the market and skip 1 strike to create an unbalanced spread.

The Construction:

Go long in 1M (1%) ITM Call

Go Short in 2 lots of 1W (0.5%) OTM Call

Go long in 2M (1%) OTM Call

The strategy has usually been executed for a net credit with the goal of having no risk to the downside should the stock keep falling.

Skipping a strike allows you do to this because you buy a further OTM call option at a cheaper price which reduces the overall cost of the strategy.

Profit potential can vary because of the BWB (Broken Wing Butterfly) aspect, at its peak you could make the difference in the 1st strike plus credit received.

Should the underlying spot FX sell off, the maximum profit would be the credit received should all the options expire worthless and OTM.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed