Off-late, Swiss managed to produce an upbeat trade surplus numbers on the flip side. The healthy Swiss trade balance has printed at CHF4.07 billion in February of 2016 from CHF2.29 billion a year earlier and beating market consensus, as exports rose while imports fell.

It is the highest surplus on record. Year-on-year, exports grew by 3.7 percent to CHF17.62 billion. In contrast, imports dropped 2.6 percent to CHF13.55 billion.

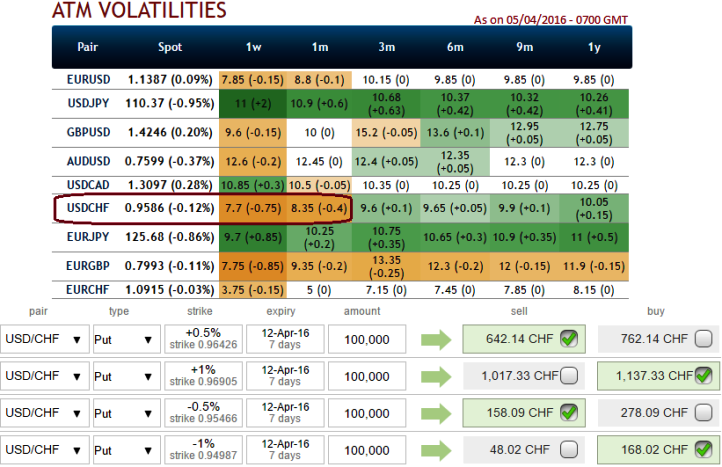

As there are no significant data releases scheduled on CHF side for this week and near future except Swiss FX reserves and CPI that can prop up USDCHF dramatically to any direction, the OTC FX option of this pair may likely to experience low volatility. You can make out from the nutshell, USDCHF is to have the second least IVs. Below is the best suitable option strategy to deal with this lower IV times.

Condor Spreads: USDCHF

We could foresee the long term downtrend has been drifting southwards, and marginal upswings on daily charts in between with clear downward convergence signals from RSI (14) and stochastic curves on monthly charts. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of upward momentum.

Since the USDCHF’s implied volatility is perceived to be minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows,

As shown in the diagram, the trader can implement this strategy using put options with similar maturities.

So strategy goes this way, writing an In-The-Money put and buying deep striking in-the-money put, writing a higher strike OTM put and buying another deep striking out-of-the-money put for a net debit.