XRPUSD pared some of its gains after Ripple's appeal. It hit a low of $0.53204 and is currently trading around $0.53704.

The SEC has ordered Ripple Labs to pay $125 million as civil penalty by Sep 6th, 2024.

Ripple has filed a letter requesting a stay of the monetary portion of the Court’s Judgment entered on August 7, 2024

Horizontal trend line- $0.680

Any daily close above $0.68 confirms further bullishness.

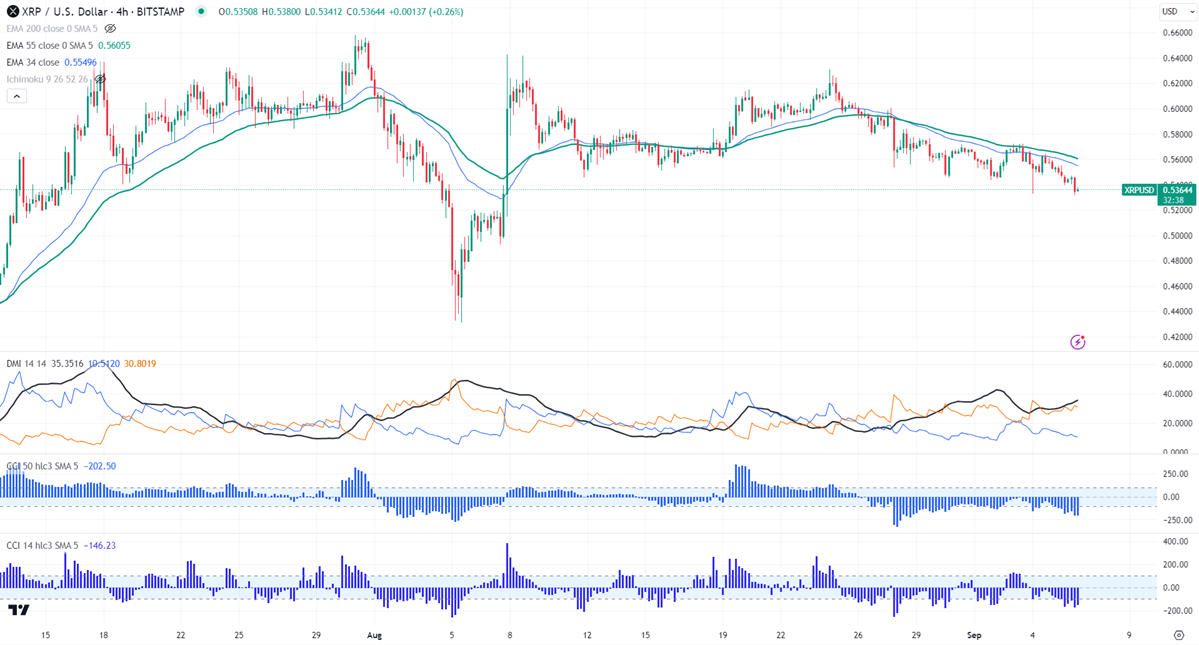

The pair holds below the short-term (34 and 55-day EMA) and long-term moving average (200-day EMA).

The near-term resistance is around $0.5500, any indicative breach above will take the pair to 0.5800/0.6170/0.6320/$0.650/$0.68/$0.75/0.820/0.900/$1. On the lower side, immediate support is $0.5300, and any violation below targets $0.50/$0.45/$0.40.

Indicators ( 4- hour chart)

Directional movement index -Bearish

CCI (50)- Bearish

CCI(14)- Bearish

It is good to buy on dips around $0.5350 with SL around $0.40 for TP of $1.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary