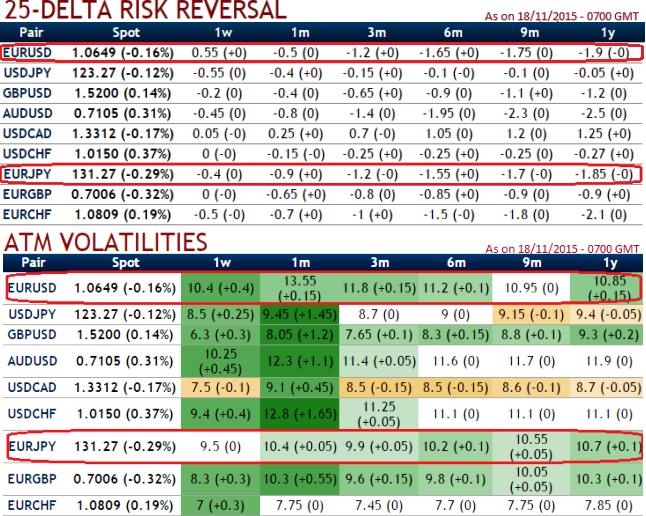

Form the nutshell evidencing 25 delta risk reversal, one can understand Euro currency crosses are expected to sense heavy stress on downside risks. EURUSD and EURJPY are displaying highest negative values in 1 year maturities.

Please be noted that risk reversals in Euro options take volatility analysis one step further and use them not to predict market conditions but as a gauge of sentiment on a specific currency pair. We observe Euro RR is directly proportionate to IVs.

Given that implied volatility is one of the most important determinants of an option's price, we use it as a proxy for market demand for a specific option.

This would mean that the seller of an OTM put option is expecting more premiums, and in turn, incurs a contractual obligation to convert currency at the predetermined exchange rate and in the amount agreed upon entry into the transaction within a specified future time period.

The combination of buy and sell transactions allow to reduce or do away with premium payments and restrict exchange fluctuations to a specified band.

Why buying risk reversal and advisable if,

The pair is willing to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate.

The international traders want to lock in a worse but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer.

The international traders are unwilling to pay or want to reduce the premium payment as compared to those payable in case of forex options.

Thus if we compare implied volatility levels across a series of options, we can get a sense for trader sentiment on a direction for this pair. Currently, the spot fx is ticking at 131.320, we reckon this would hit 130.640 levels.

FxWirePro: Why buying EURO risk reversal in the context of IVs? A brief run through

Wednesday, November 18, 2015 8:18 AM UTC

Editor's Picks

- Market Data

Most Popular