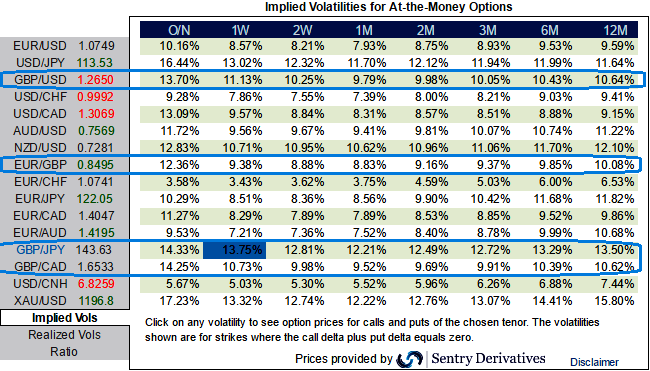

The ATM volatility of GBP crosses are reasonable rising higher levels until next week’s BoE monetary policy meeting, although we are expecting a calm down a little after another roller-coaster ride in the GBP around the BoE meeting on next Thursday.

Despite GBP/JPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit. Cable lost almost about 15% over a quarter and it now seems the dust has settled. In the process, volatility fell but remained relatively high on a historical basis. Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBPUSD volatility is a Sell.

Hence, even if the aggressive volatility investors wants to capture GBP should consider buying ATM instruments and/or being long of the smile convexity, against ATM volatility. But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 3m IV skews and risk reversal with ATM options.

Option Trade Recommendation:

Go long in 2 lots of 3m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the similar tenor, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that as shown in the diagram the trader can still make money even if he was wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news from next week’s BOE meeting that could revolve GBPJPY and you want to take your odds on downside risks – you can trade a strip.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty