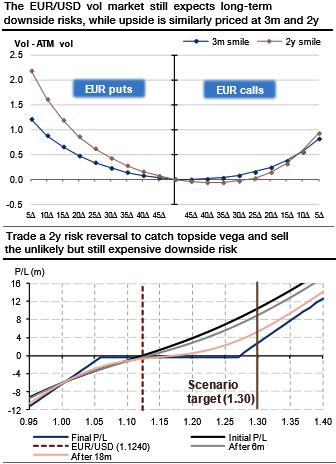

The FX options market is very liquid up to the 2y expiry. This is an appropriate horizon to capture a scenario whereby EURUSD surges to 1.30. In addition, we want to go long vol via calls, as topside vega is going to perform if the skew flips to the positive side. Both our central scenario and the alternative scenario of EURUSD breaking out of its range see a very limited probability that the spot could exit on the downside, prompting us to sell low strikes.

Smile opportunity: Comparing the volatility smile in the near term and long term is insightful. The 3m and 2y smiles price a similar topside volatility, whereas 2y puts still price an extra downside risk (refer above graph). This suggests that 2y calls are cheap since a 25-delta call will be paid at roughly the same implied volatility as a 3m call.

However, selling a 2y put is more rewarding than a shorter one, as the implied volatility of low strikes can be sold at a higher level for the same delta level. Of course, both smiles are still trading in negative territory, making EUR puts still more expensive than calls, regardless of the maturity.

We, therefore, recommend Buying a 2y EURUSD call strike 1.27 financed by a put strike 1.06 (refer above graph). This strategy costs 30pips in current market conditions (1.1240).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures