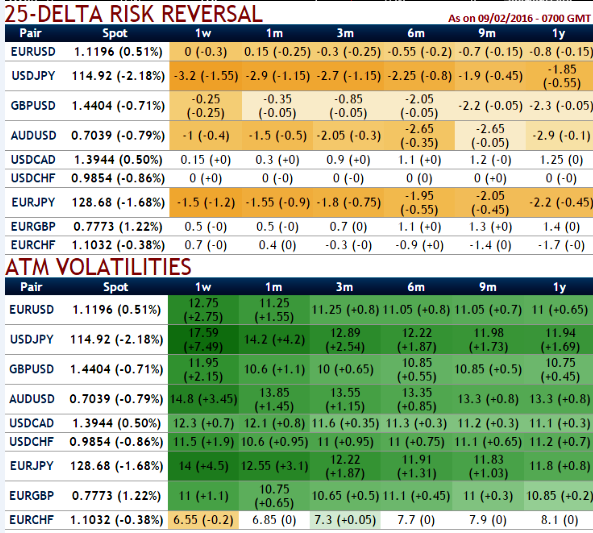

While, conducting risk reversal analysis coupled with 6M IVs, cable vols are trading much cheaper than EURGBP even though more downside potential seen in GBPUSD than EURGBP's upside risks. Although GBP volatilities are not trading at historical highs, the FX options market is already heavily positioned on the Brexit risk. EUR/GBP volatility has been discounting a fair amount of euro risk since June, as it has been trading over cable since then.

In a broader perspective within euro zone, we ponder that there would be continued crisis in between 2016 and 2018 years. After provisional rival for Greece until 2017, Now Brexit threat is lingering, while the Greece issue may still arise in euro zone at any time. About 60% of voters from countries such as Greece, Spain and Portugal have voted against the austerity measures, while the euro zone has not changed its policy. Thus, lot of political and economic turmoil in eurozone is anticipated in the months to come because they have not fix the economic framework instead opted for momentary relief.

This is a noteworthy and apparently lasting regime change, as cable volatility had been more expensive most of the time previously. But counter-intuitively, the fact that EUR/GBP options currently integrate both European and UK risks makes them a more attractive hedge than cable options. This is because the real cost of the hedge is reflected in the forward volatility, since the referendum won't be held before autumn 2016.

We define the 6M forward premium as the difference between the 6M forward volatility at a given forward date and the current 6M volatility. Forward volatilities in EUR/GBP and GBP/USD are extremely close, but the current 6M volatilities differ significantly.

Therefore, similar levels of forward volatility do not reflect the same future risk priced by the option market. It turns out that the 6M forward premium is twice as large in GBP/USD than in EUR/GBP. In our opinion, the market expects the largest disruptions in cable in the event of Brexit.

FxWirePro: What is cable vols – Risk reversals favor GBP/USD’s slumps than EUR/GBP gains

Wednesday, February 10, 2016 1:12 PM UTC

Editor's Picks

- Market Data

Most Popular