Chart and candlestick pattern formed - Bulls in the major trend so far roaring ever since it breached asymmetric triangle resistance with bullish EMA and MACD crossovers on monthly plotting.

Upswings breaking-out symmetric triangle resistance and the extension of the consolidation phase by retracing more than 38.2% Fibonacci retracements, the uptrend is now on the verge of retracing upto 50% on monthly terms.

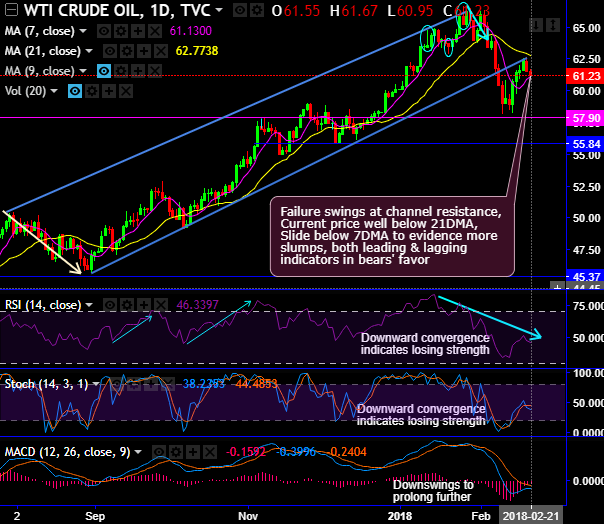

On the contrary, bears have resumed at rising channel baseline which is now acting as the stiff resistance, failure upswings at this channel resistance with downward convergence in leading oscillators (RSI & stochastic curves) are signaling more weakness on daily plotting.

In this process of the Bull Run, WTI crude prices have managed to hit 3 years highs of $66.63 but couldn’t sustain that level (refer monthly chart). Thereby, the bulls in the major trend seem to be exhausted at this juncture.

For today, the prices have been drifting in sideways but well below 21DMAs as investors seek better clarity on official weekly data from the US tomorrow, weekly inventories check by US EIA is scheduled tomorrow, both leading oscillators have been signaling selling sentiments.

On a broader perspective, let’s have a glance through the major trend that was bearish now has gone into consolidation phase that was jerky way back in mid-2015. From massive slumps from the peaks of $114 levels shouldn’t be disregarded and jumping to conclude this as a robust uptrend would be unwise, it is just 38.2% retracements.

More rallies on the cards upto next major resistance at $70.18 levels upon bullish MACD and EMA crossover (7EMA crosses over 21EMA).

Major supports are observed at $62.54 levels.

While both leading oscillators (RSI & stochastic curves) on monthly terms have been converging upwards that signal strength in the prevailing uptrend.

Hence, we’ve already advocated adding longs using futures contracts of mid-month tenors with a view to arresting upside risks, we reiterate that it is wise to use dips to deploy long hedges using these WTI derivative contracts but using mid-month tenors as well.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings