The prices of WTI and other crude oil product are back to the levels where they were when the drone attacks on Saudi oil infrastructure took place a month ago, the prices have now returned to their pre-attack levels (i.e. around $54 a barrel). Huge turbulence was seen in this one-month.

Please be noted that the implied volatility on at-the-money WTI, gasoline and Ultra Low Sulfur Diesel (ULSD) options has also similarly retreated.

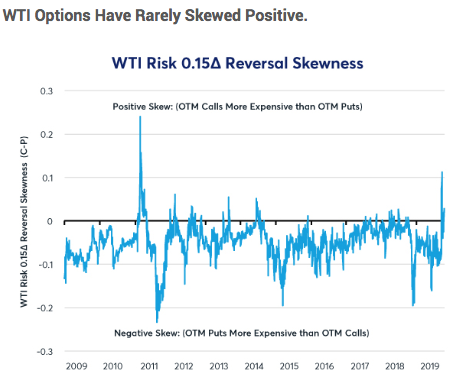

However, options skew is well off its highs, remains very different now than before the attacks on the world’s top oil exporter.

Usually, the WTI and oil products skew is negative, meaning out-of-the-money (OTM) puts are more expensive than OTM calls. After the attacks, that skewness flipped: OTM calls became more expensive than OTM puts. Since then, they have gone back in the other direction but remain much less negatively skewed than is typically the case (refer above chart).

Whether WTI and product prices decline this time, as the past relationship between options skews and subsequent movements in prices suggests is more likely than not, depends, of course, on how both fundamental and geopolitical factors play out. If inventories fall sharply, a possibility given that as much as half of Saudi oil output was offline for two or three weeks, that could boost oil prices.

Likewise, any strengthening of global demand or a supply shock of any sort could send prices much higher. Indeed, the options markets is more concerned than usual that such upside could happen.

That said, options skewness has proven to be somewhat of a contrary indicator of near-term price direction over the past decade. It’s often been that when oil traders were most worried about future price declines, prices, in fact, rebounded and when they were most concerned about upside risk, prices have the greatest propensity to fall.

Overall, one month after the Saudi oil infrastructure attacks, prices and ATM volatility are back to normal. Options skews, however, are much less negatively skewed than normal. Courtesy: CME sources

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures