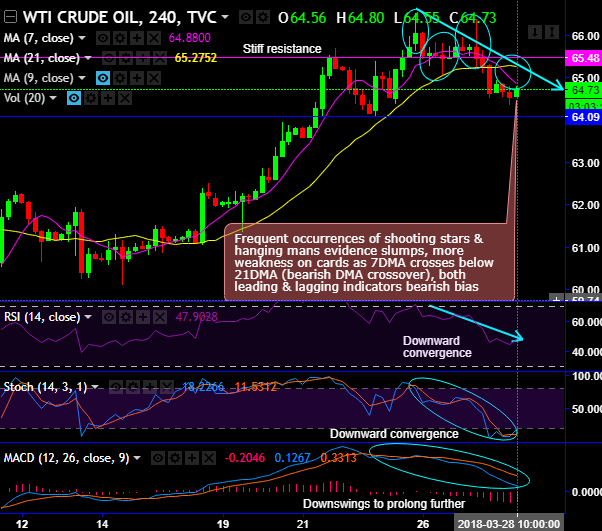

Spot out WTI CFDs frequent occurrences of shooting stars and hanging man patterns at peaks of recent rallies (refer circular areas on the daily chart). Subsequently, these bearish patterns evidence slumps, more weakness seem to be on cards as 7DMA crosses below 21DMA (which is bearish DMA crossover).

Shooting star occurred at 66.04 levels, the similar pattern has again occurred at 65.46 levels with peaks at 66.39 and 66.52 levels, thereby, one can see bearish history repeating often at the failure swings at the stiff resistance levels.

While both leading as well as lagging indicators converge downwards to the prevailing price dips that signal the strength and the intensified selling momentum.

In minor trend, both trend indicators (Moving averages and MACD) show bearish crossovers that indicate downswings to prolong further.

On the contrary, bullish break-out is spotted out from the intermediate-term consolidation phase and retraces more than 38.2% Fibonacci levels.

This week’s rally suggests the short-term consolidation phase below the January high is complete and the upside bias is back on track.

Importantly, the impulsive nature of the rally implies a bullish character shift, especially given the effective test of key support at the March and February lows. With this week’s advance leading to a break of important initial resistance levels, the more immediate focus is on the January highs.

Given the extent of the rally, we sense some near-term pause is likely to develop against these key levels, but eventual new highs appear increasingly likely consistent with our view that the medium-term uptrend is incomplete.

The renewed upside bias is in line with the break of the important 62.25/65 resistance zone for WTI. This area represents the next stiff resistance area after the break-out of triangle trend line in the last October-November.

On a broader perspective, both trend indicators (Exponential moving averages and MACD) show bullish crossovers that indicate upswings to prolong further.

Overall, one can expect more dips in the near terms, and the extension of consolidation phase in major terms despite weakness in the short run.

Hence, one can think of one-touch binary puts for the next target upto 64.09 levels, whereas we encourage longs in futures contracts of far-month tenors with a view to arresting potential upside risks.

Holders in a futures contract are expected to maintain margins in order to open and maintain a longs futures position.

FxWirePro launches Absolute Return Managed Program. For more details, visit: