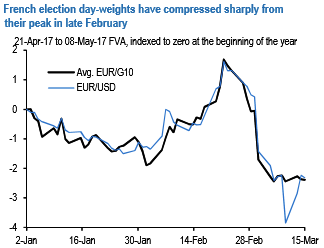

In addition to a more sanguine Fed outlook, a second factor that has weighed on vols recently is that day-weights for French elections have compressed sharply over the three weeks. EUR/G10 forward vols spanning both rounds of the election have fallen 3.8 % pts. on average (refer above chart), with the biggest declines concentrated in the most event sensitive pairs such as EURCHF and EURJPY (refer above chart).

This is reasonable since the odds of a Macron victory have risen in recent days. Polls on the first round of the French election are showing a solid lead for Le Pen and Macron over the rest of the field, with Macron now catching up to Le Pen; the second round Macron – Le Pen spread remains solidly 20%+ in favor of the former.

This is a film we have seen before with both the Brexit referendum and the US elections, when markets swung decisively one-way to de-price event risks only to have to hurriedly change course in a matter of days when the narrative changed. Without any crystal ball into the future, this strikes us as a set-up where risk-reward is favourable for a second look at pre-vs.

Post-event calendar spreads, especially on the flattest vol curves with the least day-weights even if they are outside the closely watched European bloc of currencies.

USDTWD satisfies this requirement: (a) the term structure of FVA strikes in TWD is out of kilter with the general pattern of a sharp election related jump from 1M ATM to 1M1M forward vol on most curves (refer above chart).

This is a function of our FVA pricer stripping out volatility of forward points from the implied vol surface, but the oddity of this set-up highlights that the 2M-1M ATM slope is one of the lowest and factors in minimal event risk. TWD realized vols have been tepid lately; underperforming implieds by 1-1.5 vols, so selling shorter-dated options in calendar spreads has merit.

Finally, TWD flies are historically depressed, hence the calendars are well constructed in short 1M straddle vs. long 2M 25D strangle format.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate