We do not believe the French election watershed moment for CHF. The uptrend in CHF was doubtless aggravated by political risk, and this is apparent from the accelerated intervention the SNB has needed to undertake this year to stabilize EURCHF (at an annualized 20% of GDP intervention is double the pace of last year and double the size of the current account surplus).

However, we disagree that the private sector inflows into CHF have been primarily speculative in nature (hedging by Swiss corporates, for instance, is not speculative in so far as it represents demand which is merely brought forward in time; it is not necessarily temporary demand that will reverse in the way that says hedge fund purchases would).

Equally, we do not believe that the policy tapering from the ECB will be sufficient to reverse the balance of payments pressure for CHF appreciation as there is a strong case for the SNB to undertake tapering of its own, not least as it will lack a political pretext in one weeks’ time to continue intervening at a pace that would otherwise be evidence of manipulative intent. We will watch the SNB’s weekly sight depo data with greater interest in the wake of the French election to gauge the SNB’s appetite for continued large-scale intervention.

Overall, we are comfortable with the existing cash position in EURCHF, albeit the strikes on the USDCHF have proved frustratingly elusive as expiry looms next week.

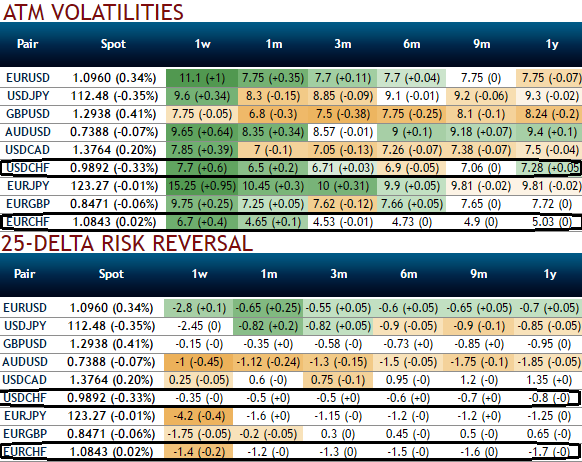

Please be noted that implied volatilities of USDCHF have been comparatively higher than EURCHF, while delta risk reversals of both pairs indicate bearish risks. Accordingly, to favor OTC indications we advocate below trade recommendations:

Hold a 2m 1.0010 - 0.95 USDCHF debit put spread.

Stay short EURCHF in cash although you have seen sharp spikes that seem momentary, we are expecting a considerable pullback from bearish rallies. Marked at -1.23%.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?