Mexican Peso has been edgy on the lingering expectations from analysts for Banxico to hike today and again once before the end of the year, and a 50bp rate increase next week seems more likely than waiting until December.

While waiting for the policy reaction, we note that the uncertainty pending on US trade policies, exacerbated by tighter global financial conditions suggests the MXN is not cheap at current levels.

True, short-term valuation models, which rely on historical co-variances of USDMXN and coincident risk indicators, suggest MXN 2.5-3.0% cheap. Yet, we believe that premium is not enough in case the newly elected US administration decides to pull the trigger on severe protectionist measures (i.e. leaving NAFTA).

Why should the Mexican central bank hike rates today having not raised rates at the press conference called at short notice last week? After all, the peso collapsed notably further. However, the change in market expectations as regards US central bank policy constitutes a new negative factor for the peso that arose this week. Against this background the market has taken the view that the Mexican central bank will have to act to prevent the peso from collapsing.

Most notably, after the recent USD rally caused by Donald Trump’s election victory and based on rising inflation and interest rate expectations continued, the new phase of dollar rallies is still on the cards as the Fed’s Christmas easing is nearing little early.

As a result of the already restrictive monetary policy measures over the course of the year and the expected change of direction in US policy the outlook for the Mexican economy is subdued. Against this background, it would probably be advisable to leave rates unchanged. However, it would probably turn out to be an even worse decision to disappoint the market as it is already nervous due to high uncertainty. By doing that Banxico would risk a further collapse of the peso which could mean that it may have to raise interest rates even further to calm the market.

Short Term Hedging Perspectives:

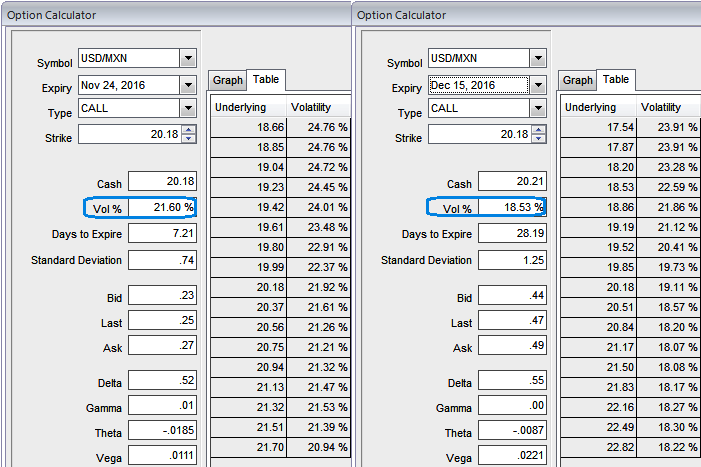

1w ATM IVs are spiking frantically above 21.6% which is quite conducive for option holders when underlying spot keeps plummeting in next 1weeks’ time; this is quite evident in payoff structure during various underlying rate scenarios.

So, as shown in the diagram, this is the option strategy in which the Mexican foreign traders who have their dollar receivable exposures are suggested to buy an at the money put option of 1m tenors while simultaneously buying an equivalent notional amount of the underlying spot FX.

Since purchasing a protective put gives you the right to sell underlying pair at the predetermined strike price, there wouldn’t be any potential threat for this exposure regardless of underlying spot rates.

The strategy is typically employed when the foreign trader is having exposure on the dollar receipts, and he doesn’t want to take any FX risks, but wary of uncertainties in this span of one month.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons