- The Turkish Lira retreated from a 2-1/2 week peak hit in the previous session following the Central Bank of the Republic of Turkey's interest rate decision.

- Turkey's central bank slashed its one-week repo auction rate by 250bps to 14 percent during its October meeting, more than market expectations of a 100bps cut.

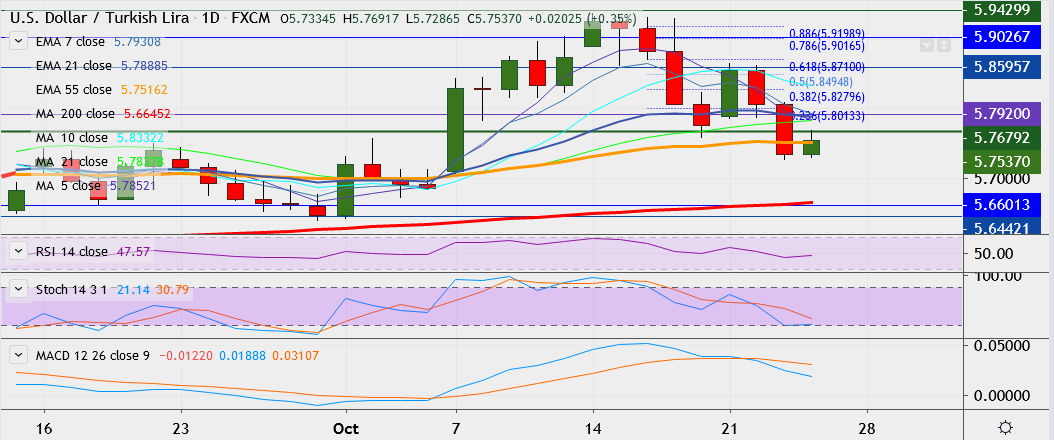

- USD/TRY is currently trading 0.5 percent up at 5.7626, having hit a low of 5.7248 on Wednesday, its lowest since October 7.

- Momentum indicators are bullish on hourly charts - RSI strong at 52.20, Stochs are biased higher and MACD support upside.

- Immediate resistance level is located at 5.7797 (21-DMA), any close above could take it above 5.8062 (7-EMA).

- On the downside, support is seen at 5.7128, and break below could take it near 5.6877.

Recommendation: Good to buy on dips around 5.7316, with stop loss of 5.7128, and target price of 5.7797