We had advised bull call spreads on 02nd and this has been three days in arrow that the pair is gaining. So thereby our ITM calls on below strategy is working pretty well and now it's the time for OTM calls which has begun its functioning as the pair has dropped from 3.0314 levels to 3.0082 levels.

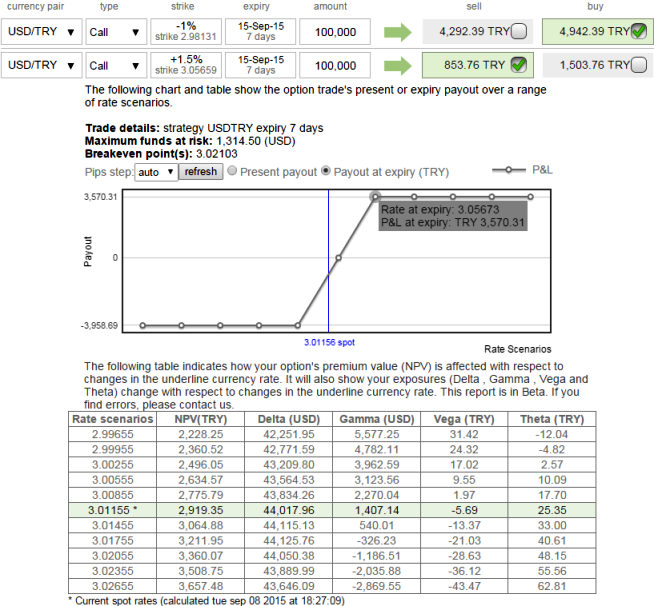

So with swing trading mindset, we still recommend buying 1M 1% in the money 0.66 delta calls and simultaneously short 7D 1.5% out of the money call, the combined delta value should be around 0.44. We've shown in the diagram as to how the strategy can be built in. However, for the demonstration purpose expiries have been identical.

Why call spread: As explained in our recent post, a short term correction is expected on this pair and because of this expectation, with a view of swing trading an OTM call shorting is advised. An investor often employs the bull call spread in moderately bullish market environments, and wants to capitalize on a modest advance in price of the underlying asset. If the investor's opinion is very bullish on USDTRY, it will generally prove more profitable to make a simple call purchase.

Risk Reduction: An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long call alone, or with the conviction of his bullish market opinion.

FxWirePro: USD/TRY longs of debit call spreads on job, shorts began functioning

Tuesday, September 8, 2015 1:01 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?