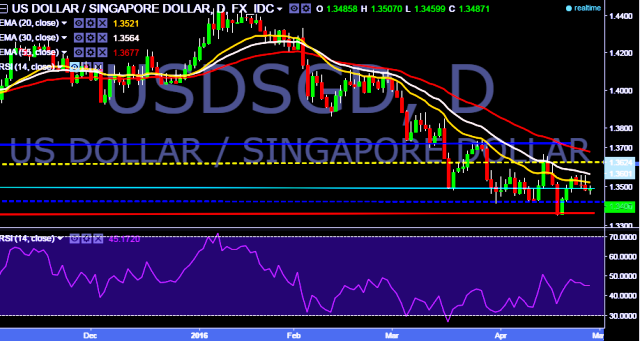

- USD/SGD is currently trading around 1.3490 marks.

- It made intraday high at 1.3507 and low at 1.3459 levels.

- Intraday bias remains bearish till the time pair holds initial

resistance at 1.3561 levels.

- A daily close below 1.3489 will drag the parity down towards 1.3420/1.3352/1.3318/1.3302 levels.

- A sustained close above 1.3561 tests key resistances at 1.3628/1.3772/ 1.3817/ 1.3842 marks respectively.

- Today Singapore released unemployment rate with flat numbers at 1.9% m/m.

We prefer to take short position in USD/SGD only below 1.3488, stop loss 1.3561 and target 1.3420/1.3361 levels.