- The Norwegian Krone retreated from a near 1-week peak following downbeat industrial production and manufacturing production data.

- Norway's industrial production tumbled 9.2 percent year-on-year in August, following a 5.7 percent contraction in July, while on a monthly basis, it decreased 2.10 percent in August.

- Manufacturing Production in Norway increased 1.7 percent in August y-o-y, compared to a 3.8 percent rise in the previous year.

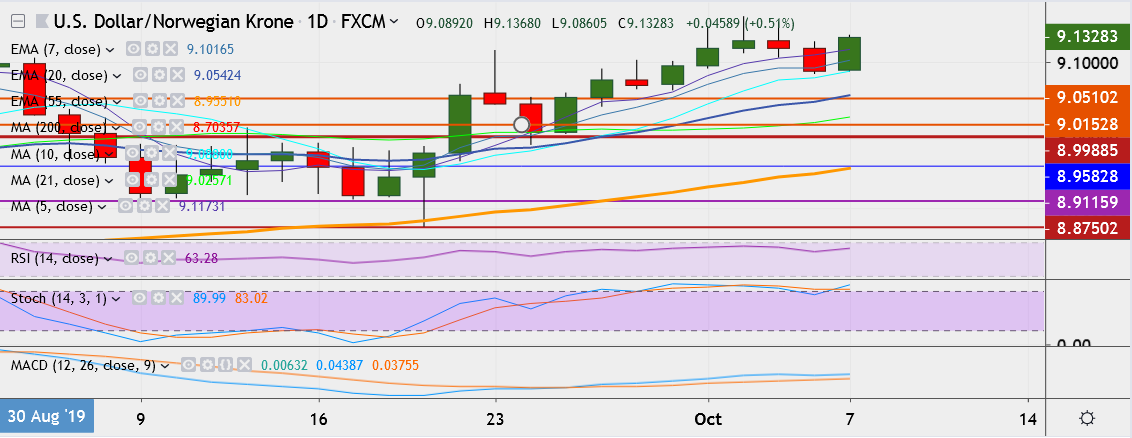

- On Friday, the pair tumbled to a 1-week trough but found strong support at 10-DMA.

- USD/NOK trades 0.5 percent up at 9.1368, having touched a high of 9.1615 on Wednesday, its highest since September 3.

- Momentum indicators are bullish - RSI strong at 62.99, MACD support upside and Stochs are biased higher.

- Immediate resistance is located at 9.1482 and a close above could take it till 9.1645.

- On the downside, support is around 9.0790 (10-DMA), break below could take it till 9.0459 (20-EMA).

Recommendation: Good to sell on rallies around 9.0912, with stop loss at 9.0790 and target price of 9.1482