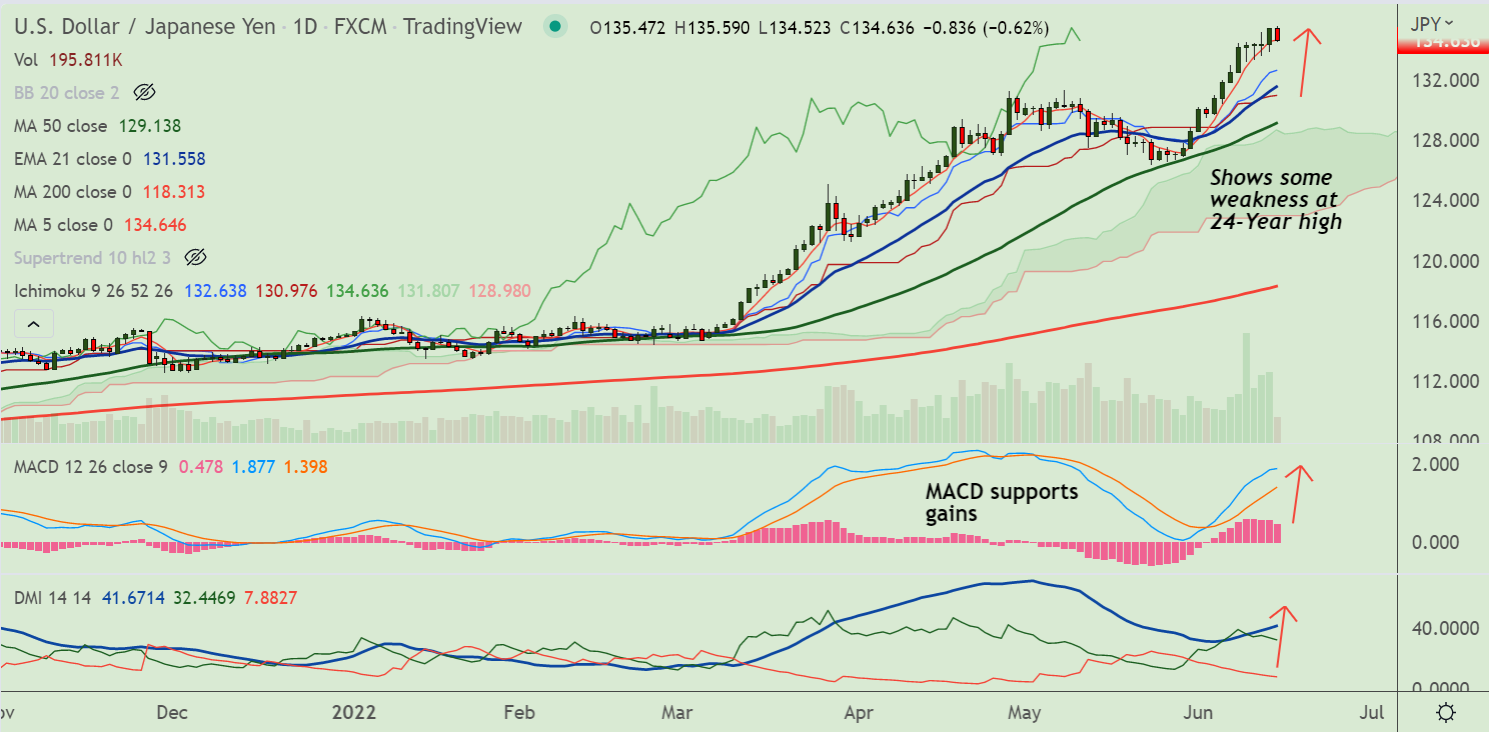

Chart - Courtesy Trading View

A rebound in the positive market sentiment has undermined demand for the US dollar.

On the data front, US PPI matched 0.8% MoM forecasts, also easing to 10.8% YoY figures versus 10.9% expected and prior readouts.

Further, core PPI (ex Food & Energy), dropped below 8.6% YoY forecasts to 8.3%, data released on Tuesday showed.

Further, markets remain cautious and refrain from placing any aggressive bets ahead of the Fed policy decision.

The Federal Reserve is expected to remain on the extremely hawkish side amid soaring inflation.

That said, signs of exhaustion were displayed by the US dollar index DXY, as clouds of uncertain Fed policy loom again.

Spot Analysis:

USD/JPY was trading 0.59% lower on the day at 134.66 at around 07:00 GMT.

Previous Week's High/ Low: 134.55/ 130.42

Previous Session's High/ Low: 135.47/ 133.87

Technical Analysis:

- USD/JPY has erased most of the previous session's gains

- Price action hovers around 5-DMA support

- GMMA indicator shows major and minor trend are bullish

- Volatility is high and momentum is bullish, but overbought oscillator warrant caution

Major Support and Resistance Levels:

Support - 133.23 (200H MA), Resistance - 136.67 (Upper BB)

Summary: USD/JPY trades with a bullish technical bias. Pullbacks on account of overbought conditions are likely to be shallow.

Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards  Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report

Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  S&P 500 Surges Ahead of Trump Inauguration as Markets Rally

S&P 500 Surges Ahead of Trump Inauguration as Markets Rally  UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts

UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts  Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  Infosys Shares Drop Amid Earnings Quality Concerns

Infosys Shares Drop Amid Earnings Quality Concerns  South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists

South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons