USD/JPY chart - Trading View

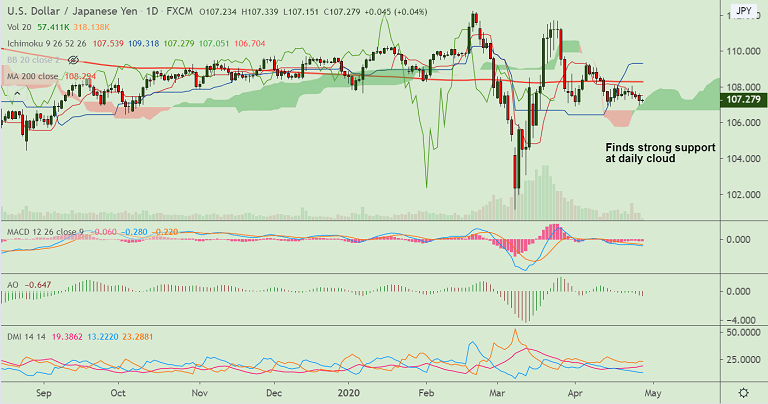

USD/JPY holding steady above 107 handle, trades in narrow range with session high at 107.33 and low at 107.15.

The pair has paused 4 straight sessions of weakness as risk reset across markets dents haven demand for yen.

USD/JPY consolidates trade below 200-DMA. The pair was trading 0.03% higher at 107.26 at around 04:00 GMT.

A 'Death Cross' (bearish 50-DMA crossover on 200-DMA) formation on the daily charts keeps downside pressure in the pair.

Indicators are aligned for bearish push and upside remains capped at 5-DMA.

Daily cloud is major support and break below will confirm further weakness. Drag till 61.8% Fib at 105.20 then likely.

Strong resistance is seen at 21-EMA (107.82). Bearish invalidation only above 200-DMA (108.29).

Major Support Levels: 106.71 (Lower BB), 106.44 (50% Fib), 105.20 (61.8% Fib)

Major Resistance Levels: 107.82 (21-EMA), 108.29 (200-DMA), 108.47 (110-EMA)

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty