The USD/JPY pair sunk sharply towards lower levels on Monday, hitting as low as 115.15, level last seen 15 months ago as renewed slide in oil prices and doubts about effectiveness of Bank of Japans interest rate policy attracted investors back in safe heaven Japanese yen.

- The Japanese yen attracted buying interest as stocks sunk and worries over china's growth continued to create anxiety among investors.

- Further upside is expected to be limited as the pair finds strong resistance at 116.00 which should limit upside and bring a decline towards lower levels.

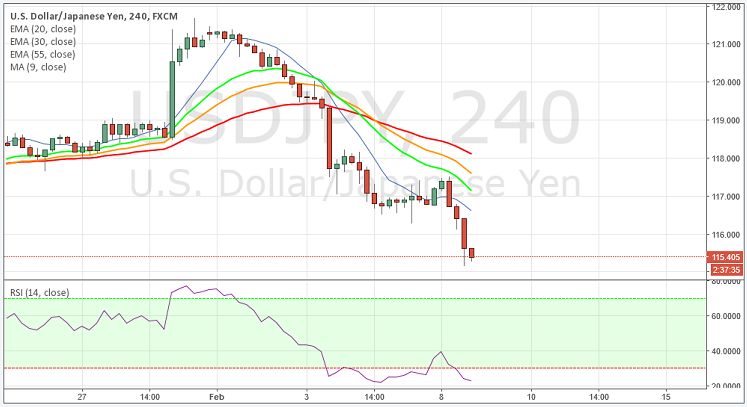

- Technically the pair has extended its decline below its 9 DMA, the RSI in the 4 hour chart is indicating downwards at 22, meanwhile the 55, 30 and 20 MA's are pointing strong bearish momentum towards lower side. Overall the technical indicators are depicting further downtrend for this pair.

- To the upside, the strong resistance can be seen at 116.00, a break above this level would take the pair towards next resistance level at 116.60.

- To the downside immediate support can be seen at 115.15, a break below this level will open the door towards next level at 114.68.

Recommendation: Go short around 115.80, targets 115.20, 114.40, SL 116.50.

Resistance Levels

R1: 116.00 (50% Retracement Level)

R2: 116.60 (9-DMA)

R3: 117.32 (61.8% Retracement Level)

Support Levels

S1: 115.15 (Daily lows)

S2: 114.68 (38.2% Retracement Level)

S3:114.00 (Psychological levels)