USD/JPY's downtrend may persist despite the upbeat prints of GDP QoQ at 1% vs forecasts at 0.4%, but this week's manufacturing PMIs would give in more insights of U.S. trades, until then we could keep foreseeing some bearish sensation.

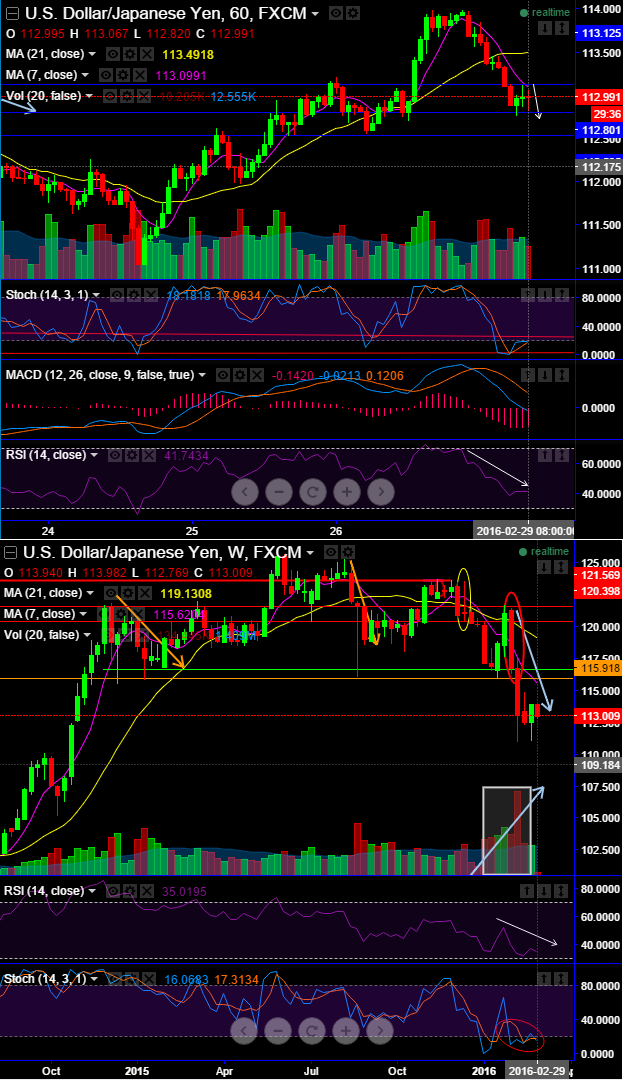

After testing the resistance of 113.129 (7MA) it has rejected from then with bearish candle patterns to signify more weakness at this juncture.

For now we can see a tight sideway trend between 113.125 - 112.800 that lasted for almost from last couple of trading hours but with some bearish candles formation.

On a broader perspective, Gravestone Doji and candle resembling bearish engulfing patterns at 121.099 and 116.798 respectively clear decisively the major supports with ease (see spiking volumes on declining swings).

With RSI evidencing clear convergence to the ongoing downtrend both on intraday and weekly plottings which is still an alarm to the bulls.

Hence, we see immediate support at 112.801 if it fails to hold these levels, travel upto 112.535 is a certain event as all technical indications from leading and lagging technical indicators favor conducive environments for bears.

Hence, considering the above aspects on speculating perspectives, we recommend deploying one touch binary puts in our strategy for targets upto 112.535 and in order to extract leverage on extended profitability. But do remember these are exclusively for speculative basis.

Implied volatility of USDJPY for 1w-1y contracts is at 13-13.5%, The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch USDJPY options are constant time and barrier levels.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. You can see that in charts how every dips would propel Vega effects in such HY instruments.

FxWirePro: USD/JPY likely to retest 112.801 after rejection of resistance at 113.129 - one touch binary put upon multiple bearish signals

Monday, February 29, 2016 8:32 AM UTC

Editor's Picks

- Market Data

Most Popular

6