The current prices jumped above 7 & 21DMA, that signals more upswings likely in short term.

The upswings are most likely as the pair breaks out above resistance at 112.670 levels.

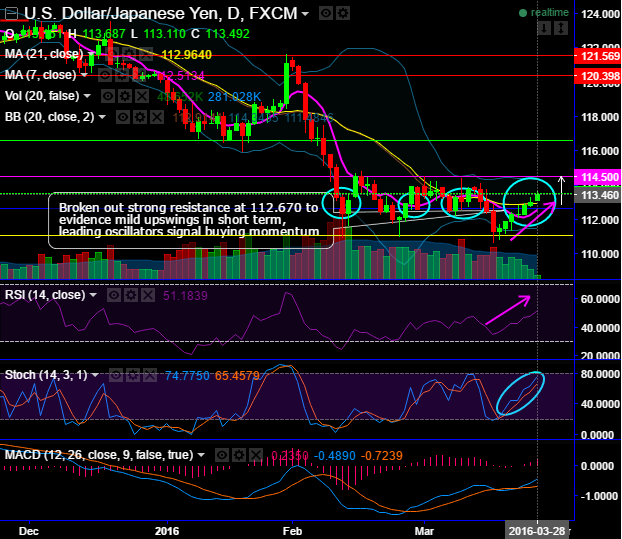

After taking major support at 111.041, it has now broken out strong resistance at 112.670 (see circled areas where it has acted as strong zone of supply and demand at this juncture) to evidence mild upswings in short term, leading oscillators signal buying momentum.

On daily chart, both leading oscillators converge the ongoing upswings, that signals more buying interest in this pair.

Current, RSI is trending upwards at 51 and above and %K crossover has been consistent on slow stochastic oscillator right from oversold region, it is now approaching almost at overbought zone but buying interest is persisting.

While, another lagging indicator (MACD) has just indicated that the short term trend to be prolonged, as a result we expect interim gains upto 114.500 levels.

Trading tips:

Since the pair has been oscillating within a range from 111.041 to 114.500 from last couple of weeks but for minor trend has been slightly bullish, on intraday speculative grounds, we recommend buying one touch binary puts in order to derive maximum leverage benefits from this upswing momentum.

Wider spreads indicates lack of liquidity. Anywhere between above stated range upto upper levels, where it is likely to travel to sense resistance at 114.500 levels, the spreads for one touch USDJPY options are steady tenor and barrier levels and the thereby returns of about 250 spot points (i.e. upto 113.750) is quite possible.

However, for short term traders on delivery grounds, we would like to go long in near month futures for targets upto 114.500 levels.

Please be noted that both the calls are exclusively meant for speculation purpose and for intraday and delivery purposes.