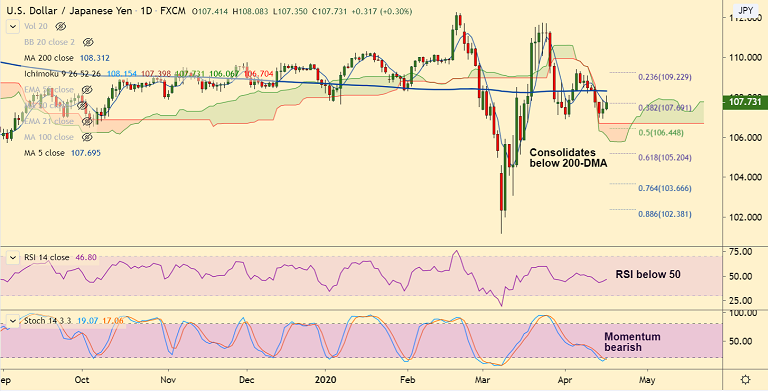

USD/JPY chart - Trading View

USD/JPY was trading 0.35% higher on the day at 107.78 at around 08:20 GMT.

The pair has edged lower from session highs at 108.08, finds stiff resistance at 21-EMA at 108.18.

The major is extending gains for the second straight session on broad-based US dollar demand.

Persistent worries over the economic fallout from the coronavirus pandemic together with Wednesday's dismal US economic data likely to cap upside.

Technical indicators do not provide a clear directional bias. Retrace above 200-DMA could see upside resumption.

Focus on U.S. weekly jobless claims data due later in the U.S. session, which might influence the USD price dynamics.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  FxWirePro: GBP/AUD dips ahead of pivotal RBA call

FxWirePro: GBP/AUD dips ahead of pivotal RBA call  USD/CHF Pauses After 200-Pip Rally — Buy Dips Near 0.775, Target 0.790

USD/CHF Pauses After 200-Pip Rally — Buy Dips Near 0.775, Target 0.790  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  FxWirePro: AUD/USD remains buoyant, looks to extend gains

FxWirePro: AUD/USD remains buoyant, looks to extend gains  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro-Major European Indices

FxWirePro-Major European Indices