USDJPY has significantly risen from the lows of 104.629 levels to the recent highs of 107.493 levels. Amid major downtrend with minor abrupt rallies, we’ve already advocated diagonal put ratio back spread about two weeks ago. For now, short legs of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

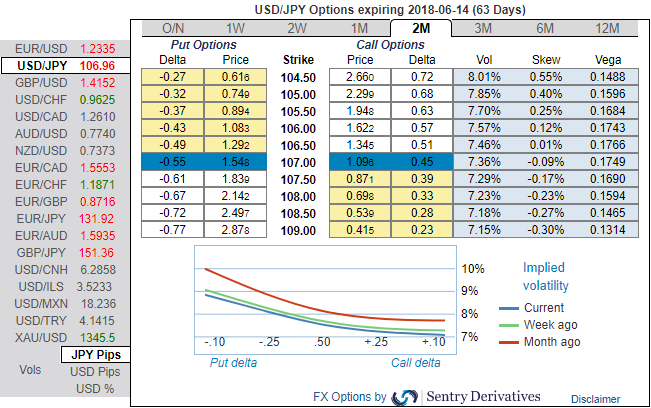

While the implied volatility of ATM contracts of USDJPY is trading back towards 7.5% for 1-3m tenors, as the positively skewed IVs of 2m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. Despite the positive shift in risk reversal numbers, the hedging sentiment for the bearish risks appears to be intact. On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 107.771/105.515 (2 lots), (vanilla: 0.75%, spot ref: 107.166). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of OTM put.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -63 (which is bearish), while hourly JPY spot index was at -80 (bearish) while articulating at 10:56 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary