Refer USD/JPY chart on Trading View

- USD/JPY is currently trading in a narrow range capped below 50-DMA at 110.98. Wide miss on Japan's trade balance data keeping pressure on.

- The Japanese yen failed to gather momentum despite BOJ rate hike talk, indicates the investors are not buying the hawkish talk.

- MNI said earlier today that the BOJ is likely setting the stage for an interest rate hike before reaching its 2 percent inflation target.

- Japan's Merchandise Trade Balance contracted much more than expected, sinking to ¥-231.2 billion compared to the expected ¥-41.2 billion.

- Details of the report showed exports sank to 3.9% y/y compared to the forecast 6.3% (previous 6.7%), while imports surged to 14.6% y/y (prior 2.6%).

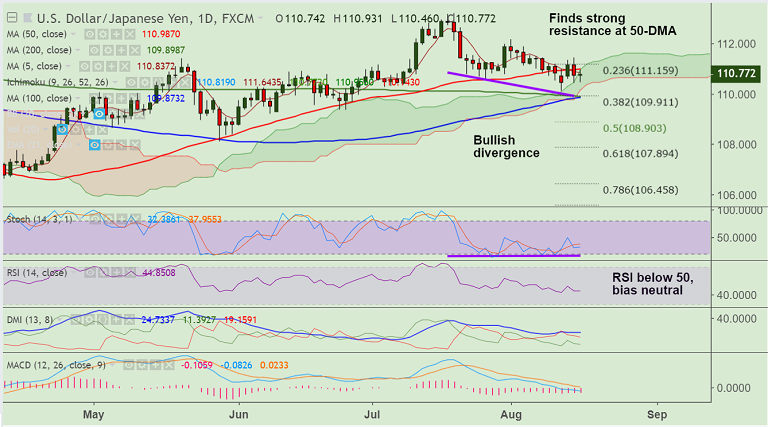

- Technical studies for the pair are neutral. However we see slight bullish divergence on Stochs which raises scope for some gains.

- Break above 50-DMA could see upside. On the other side, we see further weakness only on break below 110-EMA.

Support levels - 110.26 (110-EMA), 110.14 (cloud base), 109.89 (converged 100 & 200 DMAs)

Resistance levels - 110.98 (50-DMA), 111 (1H 200-SMA), 111.55 (channel base)

Recommendation: Good to go long on decisive break above 50-DMA, SL: 110.25, TP: 111.45/ 112/ 112.15

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -9.71328 (Neutral), while Hourly JPY Spot Index was at -73.3708 (Neutral) at 0415 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.