The rationale: Upside potential is limited in short run and this should be cushioned & used for shorts during reducing volatility times,

Thereafter, to favour major downtrend, dips should optimally be utilized so as to participate in that major trend.

Thereby, the profitability can be maximized for every shift towards downside and this is not the same on upside.

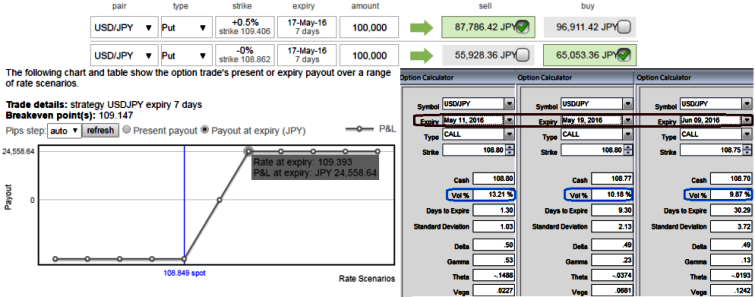

The current ATM implied volatility is spiking at 13.21% (of 1D expiry), reduced to 10.18% and 9.87% for 1W and 1M tenors respectively.

Execution: Keeping both IV and trend factors in mind, it is advisable to go long in 2W ATM -0.49 delta put while writing 1W (1%) ITM put with positive theta and delta closer to zero (both sides use European style options).

This credit put spread option trading strategy is recommended when the spot FX is anticipated to inch higher moderately in the near term and not prolonged in long term but continue with long term downtrend.

Trade expects that the underlying spot FX of USDJPY would drop to ITM strikes on expiration and thereafter drop back again.

Thereby, you are speculating the USDJPY's struggle in short run by shorting, and hedge any dramatic downside risks in long term via longs in ATM strikes which is why we advise to use narrow expiries.

Margin: Yes for ITM shorts.

Risk/Return Profile: The return is limited by ITM shorts. No matter how far the market moves above that point, the profit would be the maximum to the extent of initial premiums received.

Thereafter, if the underlying spot price keeps dipping below the strike price of the lower strike put at the short expiration date, then the bull put spread strategy suffers a maximum loss.

Effects of Volatility: No effect in short run, but yes in long term.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed