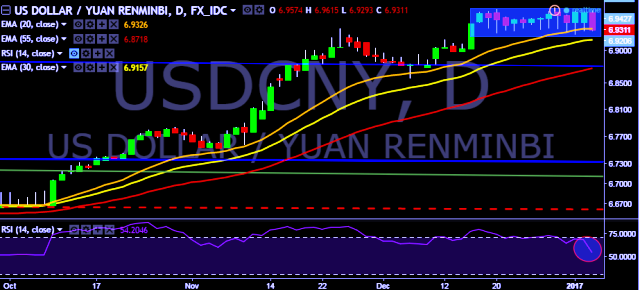

- USD/CNY is currently trading around 6.9481 marks.

- It made intraday high at 6.9615 and low at 6.9293 levels.

- Intraday bias remains neutral for the moment.

- A sustained close above 6.96 marks will test key resistances at 6.9778 and 6.9883 marks respectively.

- On the other side, a daily close below 6.9350 will drag the parity down towards key supports at 6.9204, 6.9127, 6.9026, 6.9189, 6.8983, 6.8770, 6.8510 and 6.8449 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart. Current downside movement is short term trend correction only.

- PBOC sets Yuan mid-point at 6.9526/ dollar vs last close 6.9628.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiae a long or short trade. We will continue to remain on sidelines for the time being.t