Shorting vega and downside has good risk-reward Vega volatility structurally expensive.

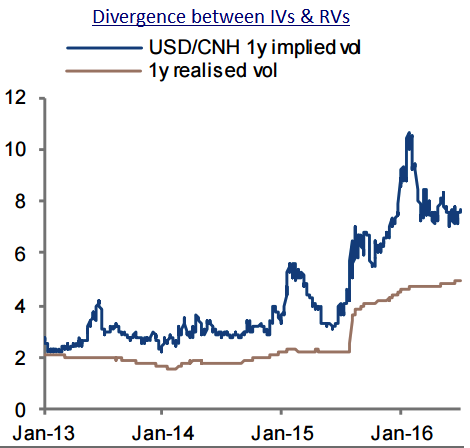

USD/CNH 1y implied volatility consistently trades at a significant premium above the realised volatility (see above graph).

The option investors have not been rewarded until now by sufficiently large spot deviations over time given this market pricing. This suggests favouring short volatility structures.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Vanilla calls or call spreads are too expensive when considering the probability-weighted terminal value of CNH a year from now.

Under the premise that USD/CNH only retraces a modest portion of the recent gains (similar to past experience when after an up move USD/CNH did not revisit the lows) and that there are no strong arguments for sustained appreciation on fundamental grounds, selling downside optionality can cheapen the cost of the call spread quite significantly.

With the help of the divergence between IVs and RVs shown in the above diagram, you can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive. This information can be used when deciding which options to buy or sell.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential