Ahead of Swiss National Bank’s monetary policy that is scheduled for this week, we expect the SNB to maintain its expansionary monetary policy stance (libor rate to remain on hold at -0.75%).

We have upgraded the risk bias around the forecasts from CHF negative to neutral. The pair (USDCHF) has been oscillating between 1.0354 – 0.8715 levels from the last couple of months. This long-lasting tight range-bounded major trend likely to prolong further.

OTC Updates and Options Strategy:

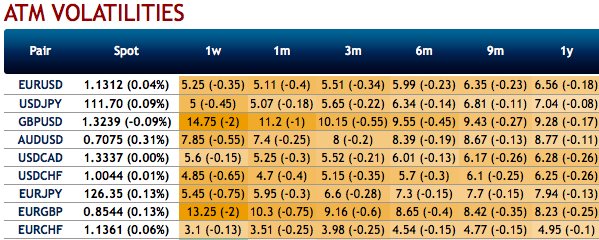

Amid the tepid underlying spot FX movements, let’s just quickly glance through implied volatility (IV) nutshell before deep diving into the strategic frameworks of USDCHF. CHF crosses are showing the least IVs among G10 FX bloc (1m IVs are at 4.7% and 3.51%for USDCHF and EURCHF respectively).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility.

Ascertaining future volatility accurately is almost impossible for any FX veteran. Nevertheless, computing the marketplace’s expected future volatility is quite feasible using the option’s price itself which is known as implied volatility (IV).

3-Way Option Straddle Strategy on Hedging Grounds: Contemplating non-directional trend and all other above rationale, the recommendation would be buying (1m) At the money +0.51 delta call and at the money -0.49 delta put options with similar expiries, simultaneously shorting an OTM call of 2w expiries.

USDCHF Strangle Shorts: As you could observe the swings in the major trend have been oscillating between 1.0354 and 0.8715 levels since June 2015 and most importantly, capitalizing on sluggish IVs it is wise to short (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of 2w tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration. Courtesy:

Currency Strength Index: FxWirePro's hourly CHF spot index is inching towards 86 levels (which is bullish), hourly USD spot index was at -98 (bearish), while articulating (at 12:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty