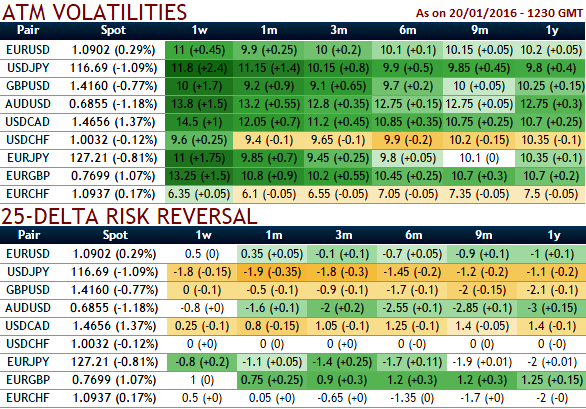

The pair is likely to perceive implied volatility close to 14.5% of 1W ATM contracts which is highest among G20 currency space, this that has increased from last week's 8.25%. While risk reversals still indicate expensive hedging for upside risks.

The BoC stands pat at its key policy rate unchanged at 0.5% yesterday despite a weaker economic outlook relative to their October forecasts.

Core inflation would be closer to 1.5%, rather than the actual 2.0% pace. Of note, in a break from past MPRs, inflation is forecast to reach 1.9% by the end of the forecast, rather than reaching the 2.0% target.

According to the USD/CAD options, the probability that the spot will trade above 1.51 in three months is 8.3%. The actual probability of such an event is likely to be even lower. It would involve a break of the FX/oil relationship, and require a 10-figure move over a quarter from 1.41, coming from 1.28 bottom in October.

Risks USD/CAD acceleration beyond 1.51 The structure is a call spread with a knock-out barrier only on the long call, set above the strike of the short call. As long as the barrier is not hit, the profit is capped by the difference between the two strikes.

The CAD robustly keeps the highest oil correlation in FX space and would feel more pain in this case.

The structure is a call spread with a knock-out barrier only on the long call, set above the strike of the short call. As long as the barrier is not hit, the profit is capped by the difference between the two strikes. However, hitting 1.51 at any time would cancel the long call, suddenly exposing investors to unlimited losses while the USD/CAD trades above the 1.47 strike.

Buy ATM USD/CAD 3M call strike 1.4212 Reverse-Knock-out 1.51, Sell call strike 1.51 on higher implied volatilities with relatively shorter expiries, spot ref: 1.4212 A buy-and-hold hedge.

Our structure is primarily a buy-and-hold strategy, since it gradually accumulates time value until expiry. The maximum profit is reached in the range 1.47-1.51 and the hedge starts to be effective at 1.42. If the spot appreciates early, investors will have to wait to be refunded by the positive theta.

FxWirePro: USD/CAD volatility warrants cautious approach as BoC stands pat in monetary policy, but commodities still a menace

Thursday, January 21, 2016 3:45 PM UTC

Editor's Picks

- Market Data

Most Popular