On monthly chart plotting, it evidences the saucer pattern on this pair, a rounding bottom of the prolonged downtrend can used to suggest that the long term trend is reversed. Currently the pair has been able to test trendline support at 1.3070 levels, if we have to compare the same with monthly plotting then we arrive with 3 black crows in a row which signals short term correction.

Since this pattern has been bullish continuation which we've been observing loony losing and dollar gaining consistently along with crude slumps as well. But for now it is looking to halt and shifting into correction mood. Generally this pattern will have a powerful move of some 10 to 24 months which we already saw since October 2012, for now the pair is heading towards a market correction mood. The pair will likely sell off into the correction in a downward fashion for maybe 20 to 35% off the old high point. The time factor is generally anywhere from 8 to 12 weeks depending on the overall market condition.

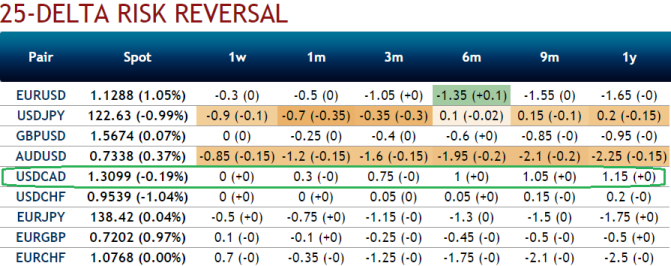

Hedging Perspectives: USDCAD

Those who expect the underling currency to make a large move higher, then the strategy can be established as follows,

Since delta risk reversal of this pair divulges expensive hedging upside risks, in order to reduce the hedging costs, Purchase more number of out of the money +0.5 delta calls and sell in the money calls with a shorter expiry usually in a ratio of 2:1. As per the delta risk reversal computation in the money calls are overpriced premiums. So the lower strike short calls finances the purchase of the greater number of long calls and the position is entered for no cost or a net credit. The dollar has to make substantial move on the upside for the gains in long calls to overcome the losses in the short calls as the maximum loss is at the long strike.

FxWirePro: USD/CAD to surge again on saucer pattern and trendline support, delta risk reversal signifies CRBS best suitable

Monday, August 24, 2015 9:08 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary