The key driving force of loonie remains the relative priced pace of policy normalization. The conjecture behind a partial retracement higher in USDCAD is the expectation that relative monetary policy pricing will converge somewhat in the coming quarters. Post the June/July repricing, BoC is now priced to hike 67bps in two years, compared to the 32bp priced for the Fed, which in other words anticipates the policy rate spread (currently 39bp) to disappear.

This current differential in expected pace of policy normalization appears largely due to differences in policy reaction functions priced by markets: As much focus as there has been on US disinflation, Canada’s inflation recent undershoot is as nearly as severe and as surprising: the cumulative core undershoot is very similar for both (1.5% in Canadian core CPI and US core PCE, having declined 0.5 over the past 9 months).

Only a handful of the analysts polled by Bloomberg expect a further Bank of Canada (BoC) rate hike today. All others, us included, believe that it will leave its key rate unchanged at 0.75%. The market reaction to the rate decision is going to be more pronounced than analysts’ forecasts suggest, as the market is pricing in a rate hike with a much higher probability (above 40%). So if the BoC was to leave everything unchanged today, CAD is likely to ease notably.

While Canada’s unemployment rate has fallen swiftly in the past 12 months (-0.7%-pts) it has remained roughly in-line with developments in the US (0.6%-pts), and BoC’s assessment is that there remains slack in Canada, whereas US is now well under NAIRU estimates.

While the US normalization cycle is well further along, historically Canadian rate cycles have lagged US ones and peaked at lower rates; In the past 20 years US-CA 2y spreads have never been negative in a tightening cycle (currently 7bp). A sustained narrowing of yields might be more convincing once the Fed does near the end of its tightening cycle, while BoC is still in the middle of its own. This is more likely to unfold after mid-18 and for that reason, and because of a projected 2H18 bounce in crude oil prices, we have CAD rebounding some to 1.30 in fresh 3Q’18 targets.

In particular, as its inflation outlook is based on stable exchange rates, but CAD is trading almost 6% above the level assumed by the BoC. Excessively aggressive rate hikes would risk an overshooting of the exchange rate.

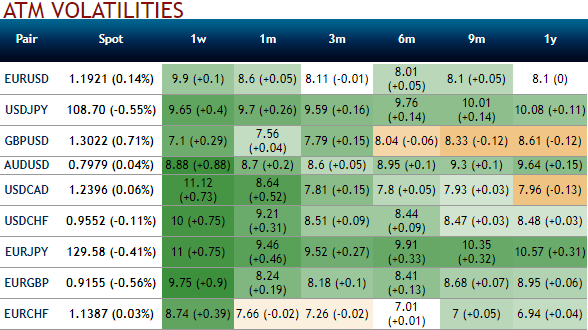

While the implied volatility remains among the three lowest G10 vols, seemingly options globally inexpensive. Despite the recent CAD appreciation, the USDCAD realized volatility has remained muted due to the low realized vol environment which makes knock-out barriers attractive.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks