Amongst other G10 currency turmoil that would suffer significantly is the Canadian dollar, given its close connection to crude oil prices in particular. Assuming further drop in crude oil prices about 15.5%, USD/CAD hitting 1.45-1.50 range would be a certain event.

The reaction of the CAD is projected to be more muted than that of the AUD because the former is already rather cheap by long-term valuation measures (having already fallen below the 2008 bottom for example).

In the ongoing Chinese economic crisis, Canada's direct economic exposure to China is much lower than Australia's. Short AUD/CAD (or even NZD/CAD) is a good relative value trade in this scenario as it has much lower directionality than AUD/USD and is less correlated to broader global risk sentiment.

The ideal situation for the bull call spread buyer is when USDCAD price to remain unchanged within shorter expiries on short side and only spikes up & beyond the strike price of the call sold when the long term call expires, as we expect USDCAD's fluctuations to show considerable upswings depending on crude's movement in the weeks to come (in next 3-4 weeks).

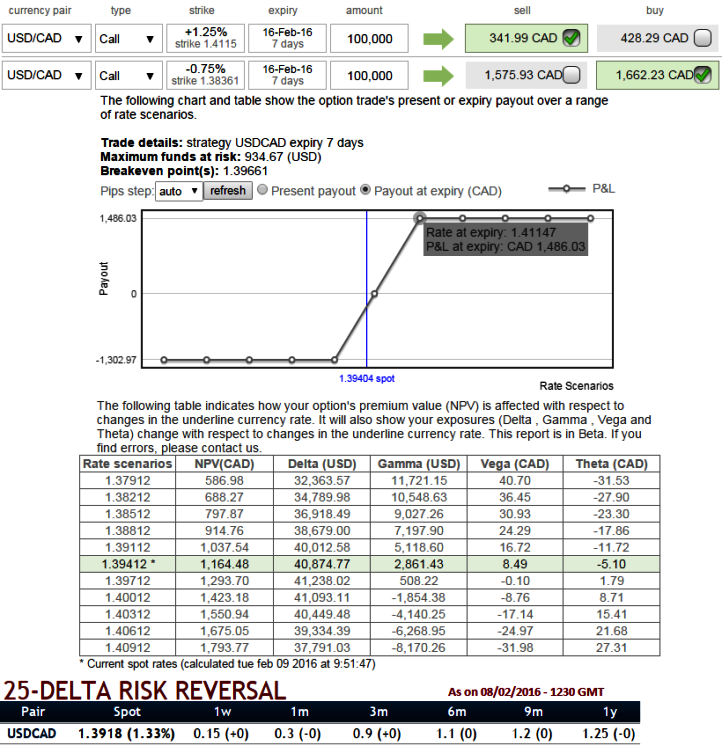

While, OTC FX market arrangements reveal hedging sentiments for upside risks, so the recommendation is to go long in 1M (0.75%) in the money 0.60 delta call while shorting 1W (1.25%) out of the money call with positive theta values and delta closer to zero. Please be noted that expiries shown in the diagram is for demonstration purpose only, use longer expiries on long side.

In this scenario, as soon as the short call expires worthless, the options trader can write another slightly OTM call and repeat this process every month until expiration of the longer-term call to reduce the cost of the trade. It may even be possible at some point in time to own the long-term call "for free".

Under this ideal situation, maximum profit for the diagonal bull call spread is obtained and is equal to all the premiums collected for writing the short calls plus the difference in strike price of the two call options minus the initial debit taken to put on the trade.

FxWirePro: USD/CAD bulls spreads for hedging

Tuesday, February 9, 2016 5:35 AM UTC

Editor's Picks

- Market Data

Most Popular