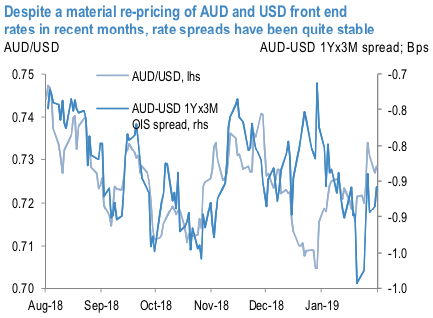

The central bank rhetoric has surprised in favor of a stronger AUD in the last month, but rate differentials haven’t really moved much. The Fed's strikingly dovish tone now sees the US front end priced for cuts, but the above chart illustrates, the AUD front end has also repriced too (despite a relatively sanguine outlook from the RBA).

Currently, the Fed curve has inverted to pricing in 5bp of cuts in the next year, while the BoC curve is still upward sloping calling for around 5bps of hikes. This now is rational, given that the Fed has signaled that the process of normalization towards neutral rates is probably finished, whereas the BoC continues to signal that rate normalization is still in-train (including from comments made by Sr. Dep. Gov Wilkins after the Fed policy shift).

In the past month, CAD has further unwound turn-of-the-year weakness, having now retraced back to mid-November levels. However, the most recent leg in CAD strength is mostly driven by the generalized lift seen across growth-sensitive high-beta assets, but is less rationalized by the typical fundamental drivers – US/CA rate spreads and oil prices are both little changed on net from a month ago.

In other words, against our short-term fair value model, recent USDCAD weakness mostly reflects a shift in risk premium (more positive for -6.4 CAD or more negative for the USD).

Options Strategy: Whatever, the ultimate effect would be an abundant acknowledgement of the policy normalization pecking order where the USD has gone from the front of the pack in terms of price hikes by end-2018, to the middle, and CAD has leaped to the top of the heap with more than 50bp hikes priced (although BoC has maintained status quo in its yesterday’s monetary policy).

AUDCAD 6M vols seem to be decent buys given their depressed levels (not far from 2014 lows) and the uberflatness of the 3M-6M vol curve.

Realized vols are not stellar however in a dollar-centric environment; hence theta bleed on vol longs is best avoided via forward volatility (FVA) structures.

So, opening positions in OTM AUD puts/CAD calls to monetize a potential correction lower in the cross is the clean directional play; one can for instance consider buying 6M 0.91 AUD puts/CAD calls with leverage in excess of 5:1 as a medium-term bearish play, where the admittedly distant barrier (8% OTMS) is still within the realm of possibility.

Alternatively, relative value constructs involving buying AUD puts/CAD calls vs. selling USD puts/CAD calls (live, no delta-hedge) appeal as low-cost ways of assuming exposure to the same directional dynamic.

OTM AUD puts/CAD calls are historically cheap and discounted in vol (and premium for the same delta) relative to OTM USD puts/CAD calls, which is odd because their spread behaves like an anti-risk asset by virtue of effectively being short AUDUSD delta, and hence ought to command a net positive premium.

Cumulative P/Ls from owning 6M 25D AUD put/CAD call – 6M 25D USD put/CAD call option spreads (bp CAD), and 6M 25D AUD puts/USD calls.

All options live (not delta-hedged) and rolled into fresh strikes monthly. Shaded bars represent vol spike episodes. No transaction costs.

The anti-risk nature of the AUDCAD – USDCAD option spread: it essentially mimics returns from an equivalent tenor/delta AUD put/USD call – but at a fraction of the cost of the latter and with outperformance in periods of calm when time decay is a drag on the latter. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing -12 (which is mildly bearish), while hourly CAD spot index was at -85 levels (bearish) at 14:00 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data